Battle of the Cards: American Express Trifecta Review

For those familiar with credit card rewards, it can make a ton of sense to pair cards together to maximize your earning. For a while, the “Chase Trifecta” was considered the best trio of cards for earning. However, with this year’s changes to the Amex Gold Card and Citi Double Cash, is there a new top trio?

Over the next week, we’ll be breaking down the best card trifecta from each of the three major banks: American Express, Chase, and Citi

In today’s installment, we’ll be breaking down our next competitor – the American Express Trifecta.

Battle of the Credit Card Trifectas: Overview

- Introduction: Which Credit Card Trifecta is Best?

- Chase Trifecta Review

- American Express Trifecta Review

- Citi Trifecta Review

- Final Verdict: Which Credit Card Trifecta is Best?

What is the American Express Trifecta?

The Amex Trifecta consists of, you guessed it! Three cards: The Platinum Card, the Gold Card, and the Blue Business Plus. Again with this trifecta, we’re aiming to maximize our earning in each category and minimize our weak spots. The Amex Trifecta does a pretty fantastic job of this.

The Amex Trifecta consists of, you guessed it! Three cards: The Platinum Card, the Gold Card, and the Blue Business Plus. Again with this trifecta, we’re aiming to maximize our earning in each category and minimize our weak spots. The Amex Trifecta does a pretty fantastic job of this.

Category Bonuses

Platinum Card

- 5x on flights booked directly with the airline or through Amex Travel

- 5x on prepaid hotels booked on amextravel.com

The Platinum Card from American Express is a leader when it comes to return on spend for flights. 5x on flights is really a fantastic return. Especially when you remember that you’ll still earn airline miles in addition to Membership Rewards points.

The 5x on prepaid hotels through amextravel.com is a fairly recent addition. It’s great to have another option to earn more points. Keep in mind that Amex Travel may not always have the lowest rate. It makes sense to price shop before booking directly with them to make sure the extra points are worth it.

Gold Card

- 4x at restaurants worldwide

- 4x at US supermarkets (up to $25,000 per year)

- 3x on flights booked directly with the airline or on amextravel.com

The American Express Gold Card revamped its earning structure in the past year, definitely for the better. The card now earns 4x at supermarkets which is industry leading. Don’t shop at the grocery store?

Don’t worry! The Gold Card earns 4x at restaurants too. Basically, if you eat, you earn points with this card. For people that love to eat (like me), that’s perfect.

Blue Business Plus

- 2x points on all purchases (up to $50,000)

The Blue Business Plus card has a simple earning structure. The card earns 2% back on all purchases up to $50,000, earning 1% back after.. If you have a card that earns Membership Rewards points, these points have the ability to convert to Membership Rewards at a 1:1 ratio.

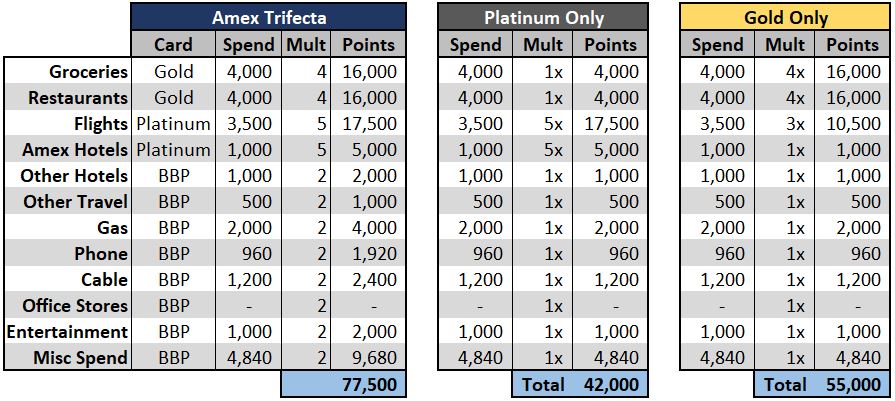

Return on Spend

At first glance, I’m pretty surprised by several things here. The first of which being how rewarding the Gold Card is over it’s competitors. From a points perspective, the American Express Gold Card really blows away both the Platinum Card and the Chase Sapphire Reserve Card (43,100). The Gold Card especially shines when it comes to food and groceries. If you don’t spend a ton on groceries and eat out for the majority of your meals, the card is still incredibly lucrative, earning 4x on both groceries and restaurants. The Blue Business Plus from American Express is also incredibly rewarding for everyday spend, earning a consistent 2% back on all purchases.

Amex Trifecta vs Chase Trifecta

I was fairly surprised to see the Amex Trifecta come out ahead of the Chase Trifecta by 15,000 points. The Amex Trifecta really excels across the board. Amex is alone or tied for the lead in multiple categories including flights, groceries, and everyday spend.

The Chase Trifecta does have the ability to close the gap depending on how much you shift your spending to gift cards. However, for the average spender, the Amex Trifecta has the ability to be a boon for points.

Annual Fees

- Platinum Card: $550

- Gold Card: $250

- Blue Business Plus : $0

- Total Annual Fees: $800

The Amex Trifecta carries the highest annual fees of the three competitors. However, the cards do come with $720 in fee credits. Whether you’ll be able to get the full value out of those credits depends on your spending habits. That brings us to our next point…

Fee Credits

Platinum Card

- $200 airline fee credit: toward incidental fees such as checked bags, seat assignments, and on-board beverages (valid only on your selected airline)

- $200 in Uber credits: $15 monthly credit with a $35 credit in December. Unused credits do not carry over to the next month.

- $100 at Saks Fifth Avenue: $50 credit for the first six months and $50 credit for the last six months of the year. Unused credits do not carry over to the next half-year.)

While you’ll see some sites boast about the “incredible $500 in value from this card!”, this isn’t one of them. Can you get $500 in value from the card? Sure. Unfortunately though, American Express has made their credits unnecessarily complicated to use in hopes of cutting costs.

The Uber credits are great if you use Uber or Uber Eats on a regular basis within the US. The same goes for the Saks Fifth Avenue credits. Personally, I wouldn’t get a ton of value out of those, so I’ll value the credits at less than face value. If you’re changing your consumer behavior to justify holding the card, you may want to reconsider whether the Platinum Card is right for you. However, if you think you’ll get full use of these, it’s still great to have.

Many travelers already opt to travel with carry-ons only and those that don’t often have have luggage fees waived with an airline’s credit card. Unfortunately, Amex closed the gift card loophole. While I’m sure there are some who still get the full use out of this credit, I can’t fully justify it. Compared to the incredibly straightforward travel credit on the Chase Sapphire Reserve, these credits are a bit disappointing.

That’s not to say that the Platinum Card is a bad card. It’s not. There are still a ton of great benefits that justify the annual fee on the card. If you’re solely counting on the fee credits to offset your annual fee, you should probably look elsewhere.

Gold Card

- $100 airline fee credit: toward incidental fees such as checked bags, seat assignments, and on-board beverages (valid only on your selected airline)

- $120 dining credits: $10 monthly at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed, or participating Shake Shack locations. Unused credits do not carry over to the next month.

Again, we’re looking at a similar case with the fee credits on the Gold Card. However, these are a bit easier to stomach with a $250 annual fee instead of a $550 annual fee. In addition, some people might find it easier to get to the $100 annual airline fee credit instead of $200 on the Platinum Card.

Travel Protection

Currently, the American Express Trifecta lags behind the Chase Trifecta in travel protection. However, that’s about to change shortly. Starting January 1st, the Platinum Card will offer the following travel protections:

- Trip Delay Reimbursement: up to $500 per ticket on delays of 6 hours or more

- Trip Cancellation/Interruption Insurance: up to $10K per person/$20K per trip

These are both welcome additions to the Platinum Card. Both the added benefits will fall in line with what is currently offered on the Sapphire Reserve. While the extent of the changes doesn’t quite mach the Sapphire Reserve Card, it’s still a positive change.

Previously if you had both the Sapphire Reserve and the Platinum Card, you had to decide whether to go for better travel protection or more points. This should help make those flight decisions easier now.

Other Perks

The perks section is where the American Express Trifecta really earns its money. The Platinum Card from American Express comes with a huge amount of benefits including:

- Centurion Lounge access: Centurion Lounges are some of the nicest domestic lounges in the US. If you frequently travel through an airport with one, this can justify the annual fee alone.

- Delta SkyClub access when flying on Delta: this is another great benefit if you fly Delta often. Delta SkyClubs are generally some of the nicer standard airline lounges in the US.

- Priority Pass Select membership

- Global Entry or TSA Precheck fee credit

- Marriott Gold Status

- Hilton Gold Status

- Fine Hotels & Resorts Program: like Chase’s LHRC, the American Express FHR gives you perks like upgrades, late checkout, and a unique property benefit like a $100 food and beverage or spa credit. However, I’d consider this program to be a bit better than Chase’s program. There tends to be a wider selection of hotels with Amex.

- Amex International Airlines Program: The IAP offers discounts on premium cabin fares departing from the US. It will typically save you anywhere from 10-20% on international business class and first class fares. Depending on the price of the ticket, that could easily be more than the annual fee of the card!

- Status with Avis, Hertz, and National rental car

- Uber VIP status

Are you as out of breath from reading those as I am from typing them?

What the Platinum Card from American Express lacks in points earning, it certainly makes up for in benefits.

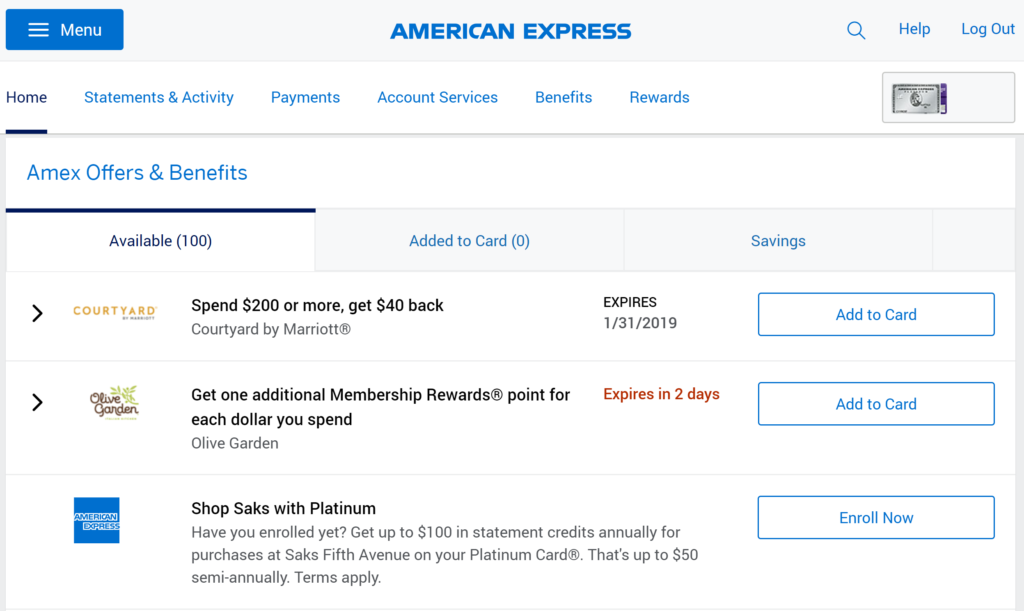

Amex Offers

Both the American Express Gold Card and the Platinum Card come with Amex Offers. These are another way to save money or earn extra points on every day expenses. These can include things like bonus points on Amazon purchases, significant rebates on travel, and huge bonuses on spending. Depending on your spending habits, it’s possible to recoup the annual fee on these alone.

Oh yeah, and if you’re stuck on 100 offers, Jon discovered a handy trick to see more Amex offers instantly.

Final Thoughts

The Amex Trifecta provides you with some awesome earning opportunities compared to its competitors. While it isn’t cheap, the trifecta arguably provides you with the most points and perks of the three trifectas. It’s up to you to decide whether the higher annual fees make this trifecta worth it. The Gold Card can be a great entry into American Express Membership Rewards due to its strong, well-rounded earning structure.

As a reminder, you shouldn’t apply for a credit card unless you’re confident you can meet the minimum spend for the sign-up bonus and you can pay off the full balance every month. If you’re confident in both of those things, the Amex Trifecta really packs an earning punch.

October 7, 2019

Although it may be difficult to standardize, I personally get tremendous additional value with Amex offers – much more so than with the Chase offers.

October 8, 2019

Good call out. It’s worth adding to the list, as both holders of the the Platinum and Gold Card can benefit from it.

October 8, 2019

Feels like I’m in the same boat.

Once I started using my Gold, I’m noticing I’m not changing my spending habits but my points are doubling/tripling compared to my old card due to the offers. The recent Amazon offer was pretty good at +2 MR points per dollar spent and some I get on the gold make it better to use that than the BBP straight up.

October 8, 2019

Don’t get me wrong, I hold the Amex Trifecta and I make great use out of it. But to be fair, there needs to be a column showing the earnings using the BBP only.

The math works out to 48k points earned on the same spend using the BBP only, which is better than the Plat’s 42k and pretty close to the Gold’s 55k – all for no annual fee. And, the BBP also has access to Amex Offers.

Pair the BBP with the Gold, and you’ve got 67.5k – only 10k behind the full trifecta yet shaving-off the Plat’s $550 annual fee.

October 8, 2019

Glad to hear you feel that you’re getting great use out of the Amex Trifecta. Your point on the BBP is definitely a worthwhile consideration. Trust me, I love to geek out in spreadsheets as much as anyone else. For the sake of simplicity and those who aren’t though, I wanted to limit it to one or two cards. When it came down to it, it made the most sense to break down cards with more complex earning structures. For the cards with simple earning structures (CFU, BBP, Citi Double Cash), readers can can just multiply their total spend by the earn rate (1.5 or 2).

As for the Platinum Card, I agree with you. It’s not the most rewarding card from a points perspective. The comparison to the Gold Card shows it. The Platinum Card excels in perks while others excel in points. It’s up to readers to decide whether those perks are worth it to them. If you’re in it for the perks though, might as well collect those extra points. Thanks for taking an active interest in the article. Hope you enjoy the rest of the series 🙂