Battle of the Cards: Chase Trifecta Review

For those familiar with credit card rewards, it can make a ton of sense to pair cards together to maximize your earning. For a while, the “Chase Trifecta” was considered the best trio of cards for earning. However, with this year’s changes to the Amex Gold Card and Citi Double Cash, is there a new top trio?

Over the next week, we’ll be breaking down the best card trifecta from each of the three major banks: American Express, Chase, and Citi

In today’s installment, we’ll be breaking down the most popular of the three – the Chase Trifecta.

Battle of the Credit Card Trifectas: Overview

- Introduction: Which Credit Card Trifecta is Best?

- Chase Trifecta Review

- American Express Trifecta Review

- Citi Trifecta Review

- Final Verdict: Which Credit Card Trifecta is Best?

What is the Chase Trifecta?

The Chase Trifecta consists of three main cards: the Sapphire Reserve, the Ink Business Cash, and the Freedom Unlimited. As is the case with any credit card trifecta, we’re looking to maximize our points earning. After all, we’re always looking for ways to earn more points for things you already spend on.

The Chase Trifecta consists of three main cards: the Sapphire Reserve, the Ink Business Cash, and the Freedom Unlimited. As is the case with any credit card trifecta, we’re looking to maximize our points earning. After all, we’re always looking for ways to earn more points for things you already spend on.

Is there a Chase “Quadfecta”?

Maybe you’re reading this and wondering, “What about the Chase Freedom?” Well it’s called the Chase Trifecta after all. However, it was a close call between the Ink Business Cash and the Chase Freedom. I view these cards as interchangeable depending on your situation. The Chase Freedom just gets edged out due to the lower spending cap on bonus categories. However, if you don’t see much value in the Ink Business Cash card, the Chase Freedom Card is a great no-fee replacement.

If you really want to go hog wild, add the Chase Freedom to your trifecta to make it a Chase “Quadfecta”. The Freedom comes with no annual fee and earns 5x on rotating quarterly categories, up to $1,500. That’s potentially another 20,000 points if you max out the benefit! If you’re under 5/24 and looking for another way to boost your Ultimate Rewards earning, adding the Chase Freedom Card could make a ton of sense.

Category Bonuses

Sapphire Reserve

- 3x on all travel expenses

- 3x on dining

Part of what makes the Chase Sapphire Reserve so great is the lack of hoops you have to jump through. The bonus on travel isn’t just limited to flights or hotels. It includes things like trains, Uber, parking, buses, and just about any other form of transportation you can imagine. It’s also worth noting that you won’t receive any points on the $300 travel credit, which seems reasonable.

In addition, you’ll earn 3x points on dining anywhere – including restaurants outside of the US. This is great if you travel a decent amount, especially abroad, as several other cards do not offer bonus points on international dining.

Again, easy and rewarding is the name of the game when it comes to the Chase Sapphire Reserve.

Ultimate Rewards points are great for stays at Hyatt properties like the Park Hyatt Tokyo (courtesy of Hyatt.com)

Ink Business Cash

- 5x at office supply stores

- 5x on phone, cable, and internet bills

- 2x at gas stations

- 2x at restaurants

The Chase Ink Business Cash is intended for small business owners and the bonus structure clearly reflects that. The phone, cable, and internet bills are something most people shouldn’t have an issue spending on. The restaurant category bonus isn’t particularly useful with the Sapphire Reserve already earning 3x.

Where the Ink Business Cash really has earning potential is with 5x back at office supply stores, up to $25,000 per year. Stores like Staples and Office Max sell a ton of gift cards for large national retailers. Instead of just earning 1.5% back at a store like Target, you could buy a Target gift card from Staples and earn 5x on that purchase. It’s an extra step, but can really add up over time.

It’s also worth nothing that the Ink Business Cash is a business card intended for small business owners. Not everyone will be comfortable applying for a business card. If you’re not interested in a business credit card, consider swapping out this card for the Chase Freedom.

Freedom Unlimited

The Chase Freedom Unlimited Card is the most straightforward of the bunch, earning 1.5% back on all purchases. The card traditionally earns cash back. However, if you have a card that earns Ultimate Rewards points, those points can convert to Ultimate Rewards at a 1:1 ratio.

Return on Spend

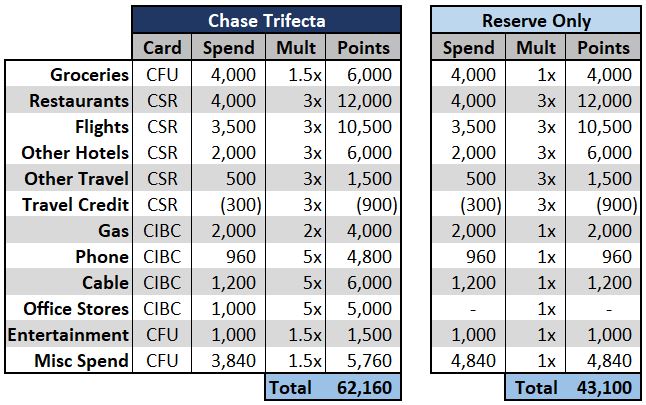

I’m going to go out on a limb here and say this is probably the part you’re most interested in. After all, this is the Battle of the Cards. So, how does the Chase Trifecta stack up?

As you can see, having the Chase Trifecta earns nearly 20,000 more points than only having the Sapphire Reserve. For adding two additional no-fee cards to the mix, I’d say that’s definitely a worthwhile investment.

Where there’s really room for significant upside is with the Office Supply Store category. I’ve conservatively assumed that you’ll spend at least $1,000 at office supply stores if you have the Chase Ink Business Cash. However, you could easily spend more in that category on gift cards for major retailers you commonly visit.

Annual Fees

- Sapphire Reserve: $450

- Ink Business Cash: $0

- Freedom Unlimited: $0

- Total Annual Fees: $450

The Chase Trifecta checks in with the lowest annual fees of the three competitors with total annual fees of $450. However, when you consider the Reserve Card’s $300 travel credit, the effective annual fee is essentially $150.

Fee Credits

The Chase Sapphire Reserve card is the only one of the trifecta that includes any kind of credits. The card comes with a $300 annual travel credit. This credit is automatically applied to any travel-related purchases on your account, making it incredibly easy to use. The only downside is that you won’t earn points on those $300. It was generous that they even offered points on this in the first place, so I don’t view this as a huge loss.

Travel Protection

This is where the Chase portfolio really outshines its competitors at the moment. Citi recently gutted travel protection benefits from their cards, while Amex won’t be adding any of these protections until 2020.

Chase Sapphire Reserve

- Auto Rental Collision Damage Waiver: primary coverage up to $75K in the US and abroad

- Roadside Assistance: $50 limit, up to 4 times per year

- Trip Delay Reimbursement: up to $500 per ticket on delays of 6 hours or more

- Luggage Delay Reimbursement: up to $100 per day for up to 5 days

- Lost Luggage Reimbursement: up to $3K per person

- Trip Cancellation/Interruption Insurance: up to $10K per person/$20K per trip

- Emergency Evacuation & Transportation: Up to $100K

In addition, the Chase Sapphire Reserve Card also comes with some solid purchase protection. I’ve used the extended warranty before and the process was surprisingly user-friendly.

- Extended Warranty Protection: extends the manufacturers warranty by one year on eligible items

- Purchase Protection: covers new purchases for up to 120 days against damage or theft ($10K per claim, $50K per year)

- Return Protection: get reimbursed for items the store won’t take back within 90 days, up to $500 per item

Ink Business Cash

The Ink Business Cash also features primary rental car insurance and purchase protection. While nice, I don’t view this as a major selling point considering the Reserve already has both of these.

Other Perks

The Chase Sapphire Reserve Card also comes with a gluttony of perks to enhance your travel experience.

- Lounge access for you and two guests with a Priority Pass Select membership: What differentiates this membership from the other premium cards is that Chase will also allow you to visit Priority Pass restaurants. Restaurants like The Grain Store are some of my favorite options when it comes airport dining.

- Global Entry or TSA Precheck fee credit

- The ability to transfer or redeem points at 1.5 cents per point: points can be redeemed through Chase’s hotel and airline transfer partners or for 1.5 cents each through the Chase Travel Portal (instead of 1.25 cents per point with the Sapphire Preferred).

- Luxury Hotel & Resort Collection: hotels booked through the LHRC give you perks like upgrades, late checkout, and a unique property benefit like a $100 food and beverage or spa credit.

- Status with Avis and National rental car

- 24/7 direct access to customer service: while I haven’t had to call a ton, it’s always nice to be able to speak to a human immediately. This isn’t a perk, so much as it’s an expectation for a card with a $450 annual fee, but still nice to know it works.

Final Thoughts

The Chase Trifecta is a great way to increase your points earning without much effort. At no additional cost, the average person stands to gain nearly 20,000 extra points per year just by having it. If you have or are planning on getting the Chase Sapphire Reserve Card, there’s little reason not to add the Chase Ink Business Cash and Chase Freedom Unlimited cards to your wallet as well.

That being said, you shouldn’t apply for a credit card unless you’re confident you can meet the minimum spend for the sign-up bonus and you can pay off the full balance every month. If you’re confident in both of those things, the Chase Trifecta can make a great addition to your wallet.

October 7, 2019

Question on the Chase Sapphire Reserve..

Does the travel protection work as long as you’re holding the card, or only if you purchased that trip with the CSR card?

ie: If you bought plane tickets in advance with another card, then apply and receive the CSR afterwards.

October 7, 2019

You’ll have to have paid for at least part of the ticket using the card. Even if you only pay taxes and fees on an award ticket with it though, you’ll still be covered.

October 7, 2019

That is what I expected, thank you.

Reason I ask is that I already have a fully paid ticket that I purchased with my old JAL card that I since cancelled and recently got approved for a CSR.

Apologies for what seemed like an obvious question, still a little new to the travel/rewards cards thing.

October 7, 2019

No need to apologize! We all have to start learning somewhere 🙂

Congratulations on the approval and always feel free to reach out with questions.