Why, and how, we pay rent with credit

Credit cards are one of the best and easiest ways to rack up a ton of miles and points every year, but it can be quite difficult at times to hit those minimum spends each year, especially if you’re applying for more than one card a year. The card we just applied for, the Delta Skymiles American Express, requires $50,000 a year in spending to earn the full 20,000 elite miles promised as a benefit of the card.

It seems that all of our friends ask us if they can pay the mortgage or rent with credit cards, and the answer for the longest time was “nope,” but then companies like RadPad and even BlueBird/Serve from American Express came into play.

Bluebird fell by the wayside for many people earlier this year, and RadPad charges too much, but then comes Plastiq to the rescue.

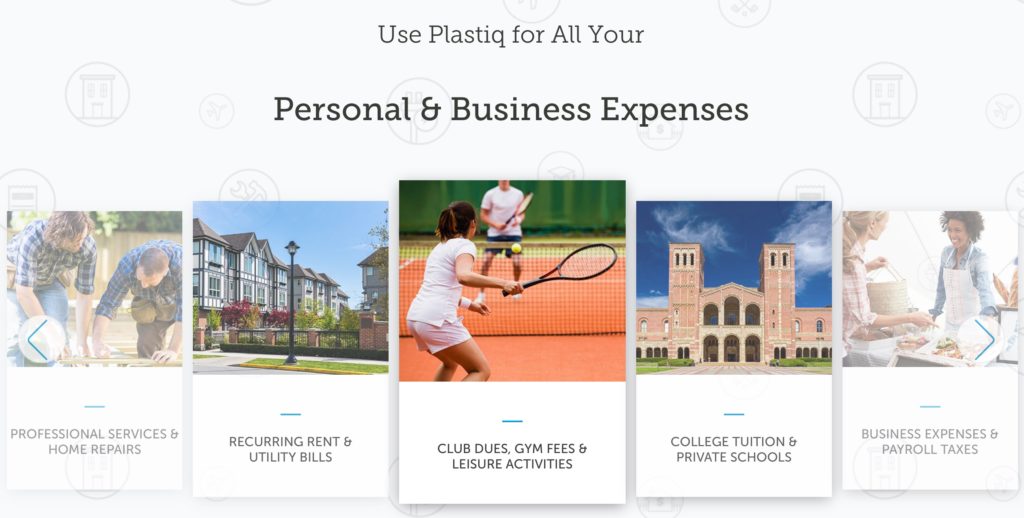

Plastiq is an easy way for you to pay any bill with a credit card that usually you wouldn’t be able to. Think rent/mortgage/etc, and now you can earn miles by doing so.

Easy isn’t always cheap however, as Plastiq does charge you a fee for paying your bills. Usually the fee ranges from 2-3% depending on the type of card that you use (Visa, Mastercard, American Express) but every now and again, there’s a promotion, just like now! Right now if you schedule 6 payments the fee reduces to 2.25% for American Express and 1.75% for Mastercard.

So, being that it costs over 2 cents a mile, why do we pay rent with our credit cards? Like we mentioned earlier, hitting all those high minimum spend requirements are hard to do, and some credit cards are cracking down on Manufactured Spend. Recently, Amex clawed back some membership rewards points from users who bought gift cards or otherwise manufactured spend to get to their minimum spend requirements. Now more than ever, it’s becoming more important to actually use your credit card for spend. So while it does cost $30-40 a month to pay the rent, if we can do it for 2-3 months and earn those 50k, 80k, or 100k spending bonuses, then in our book it’s a win.

I don’t know if it’s something that we would do long term, as it can get pricey for long periods of time, but in the short term it’s a great way to earn the miles bonus.

If you sign up now, you can get the first $200 of processing for free, and as a thank you, Plastiq will give us $200 as well. It’s a nice little bonus, and it does make a difference. Do you have any credit cards that you’re having trouble meeting those minimum spends? Give Plastiq a try.

October 15, 2016

So true. In doing the math, it can be worthwhile depending on the situation!

October 20, 2016

Registered using your linky – Thanks! Might be a good way to hit the minimum spend on the AmEx Business Platinum…

October 20, 2016

Thank you! I think so, for sure 🙂 I know it’s helping me hit MY Amex minimum spend.