WARNING: Your Bank is about to Tax your Airline Miles

As someone who collects hundreds of thousands of airlines miles every year, I’ve enjoyed the benefits that they bring. For years now, the IRS has ruled that airline miles are not taxable income.

I had always feared this day would come, but in my heart, I never really thought it would have any legs… until now.

The Letter

Ben received a curious letter in the mail (actual mail, not email) today from BankDirect. For those of you that aren’t familiar with BankDirect, it’s based out of Richardson, TX, a suburb just north of Dallas. Since they’re so close to the headquarters of American Airlines, their bank is a little different.

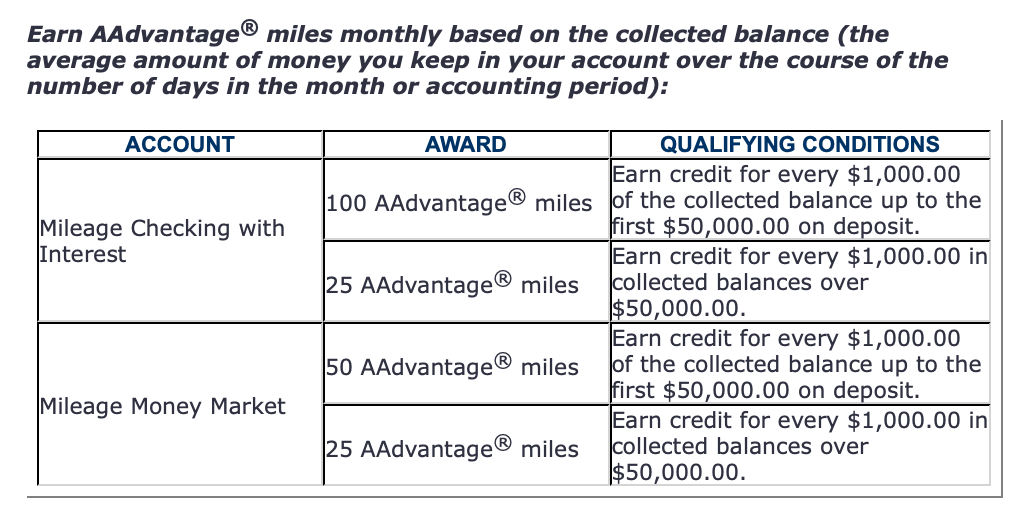

Instead of earning interest on your checking and savings accounts, you can earn American Airlines AAdvantage Miles.

For every $1,000.00 of the balance in your checking account (up to $50,000) you earn 100 miles a month. That means that if you kept the full $50k in your account, you would earn 5,000 miles a month or 60,000 miles a year. Not a bad haul!

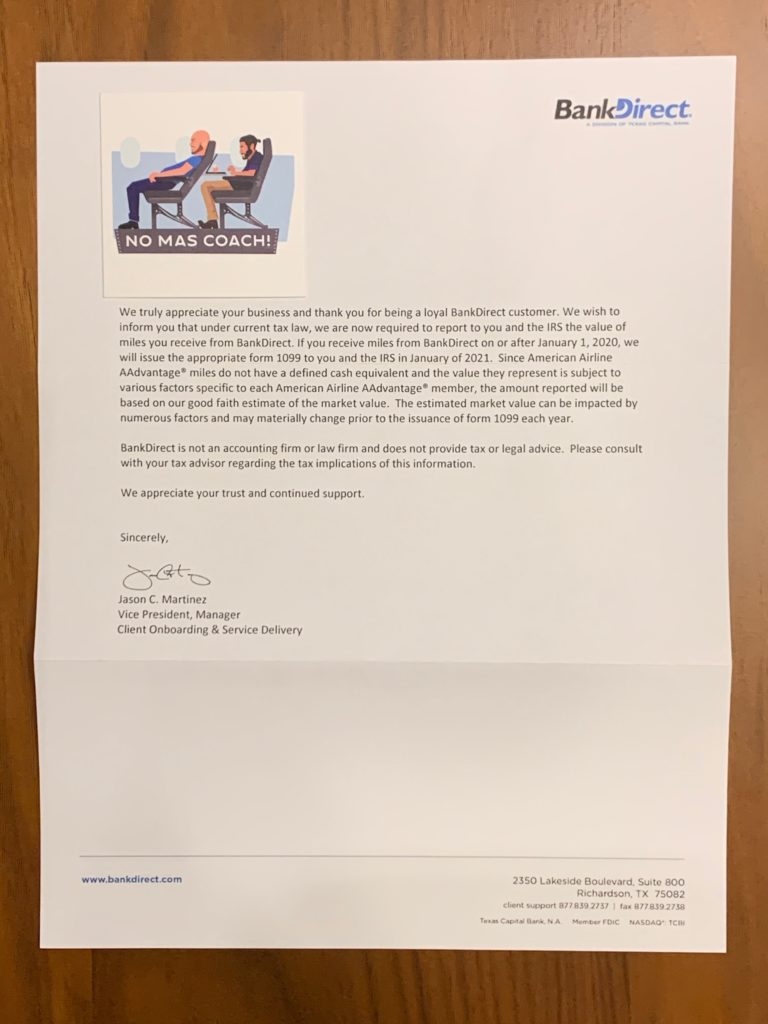

The letter that arrived today, I think, is a harbinger of bad things to come, and we’re planning on fighting with every ounce of our being. Below is the photo scan of the letter but I’ve included the text here as well. Bolding is my own:

We truly appreciate your business and thank you for being a loyal BankDirect customer. We wish to inform you that under current tax law, we are now required to report to you and the IRS the value of miles you receive from BankDirect. If you receive miles from BankDirect on or after January 1, 2020, we will issue the appropriate form 1099 to you and the IRS in January of 2021. Since American Airlines AAdvantage miles do not have a defined cash equivalent and the value they represent is subject to various factors specific to each American Airline Advantage member, the amount reported will be based on our good faith estimate of the market value. The estimated market value can be impacted by numerous factors and may materially change prior to the issues of form 1099 each year.

Bank Direct is not an account firm or law firm and does not provide tax or legal advice. Please consult with your tax advisor regarding the tax implications of this information.

We appreciate your trust and continued support.

SincerelyJason Martinez

Vice President, Manager

Client Onboarding & Service Delivery

I’m going to give you a moment to pick yourself up off of whatever floor you just fell onto.

This. Is. A. Big. Deal.

Dissecting the Letter

Interestingly enough, the letter references current tax law, and because of that current tax law they must start reporting next year all the miles that they give to their members. On top of that, you have no say in what BankDirect thinks the miles are worth. You’re at the whim of the bank to whatever value they assign.

This is very interesting considering in an IRS publication from 2002, the IRS made it clear what they felt about the value of airline miles. Bolding, once again, is my own.

Questions have been raised concerning the taxability of frequent flyer miles or other promotional items that are received as the result of business travel and used for personal purposes. There are numerous technical and administrative issues relating to these benefits on which no official guidance has been provided, including issues relating to the timing and valuation of income inclusions and the basis for identifying personal use benefits attributable to business (or official) expenditures versus those attributable to personal expenditures. Because of these unresolved issues, the IRS has not pursued a tax enforcement program with respect to promotional benefits such as frequent flyer miles.

Consistent with prior practice, the IRS will not assert that any taxpayer has understated his federal tax liability by reason of the receipt or personal use of frequent flyer miles or other in-kind promotional benefits attributable to the taxpayer’s business or official travel. Any future guidance on the taxability of these benefits will be applied prospectively.

This relief does not apply to travel or other promotional benefits that are converted to cash, to compensation that is paid in the form of travel or other promotional benefits, or in other circumstances where these benefits are used for tax avoidance purposes.

Now, the parts that I bolded reference the IRS’s stance on miles resulting from business travel. In the last section, it mentions that the relief does not apply to promotional benefits that are converted to cash, paid in the form of travel OR other promotional benefits. But, what exactly does that mean? What is a “promotional benefit?” and will it be taxed?

Good Faith Estimate

The bank states that they will use a GFE, or Good Faith Estimate, to determine the value of the miles that they’ve issued to you. Who’s to say that the miles I am accumulating have a cash value of $.01 each? What if the value I get out of the miles only gets me a $150 flight? What about a $1500 flight? There has to be some baseline level.

What if I am only accumulating the miles but don’t intend on using them for another 2 years?

What about the cost that BankDirect is paying for those miles. Shouldn’t that come into play?

Disputing the 1099

Just because a company sends you a 1099 form, it doesn’t mean that you are without your rights. This website here outlines the steps to dispute a 1099 if, for whatever reason, the pricing doesn’t look right when they sent it over.

- Gather your supporting documentation. If you believe that the amounts are incorrect, make sure to have your proof.

- If the company doesn’t correct your 1099 after you have requested it, call the IRS at 800-829-1040 and explain your situation. They will reach out and requested a correct 1099.

- If the company doesn’t reply by April 15, you may claim the amount you believe is correct on your tax return without a new 1099.

- Write a statement explaining why and attach it to your taxes

How will you know what a true good faith value is?

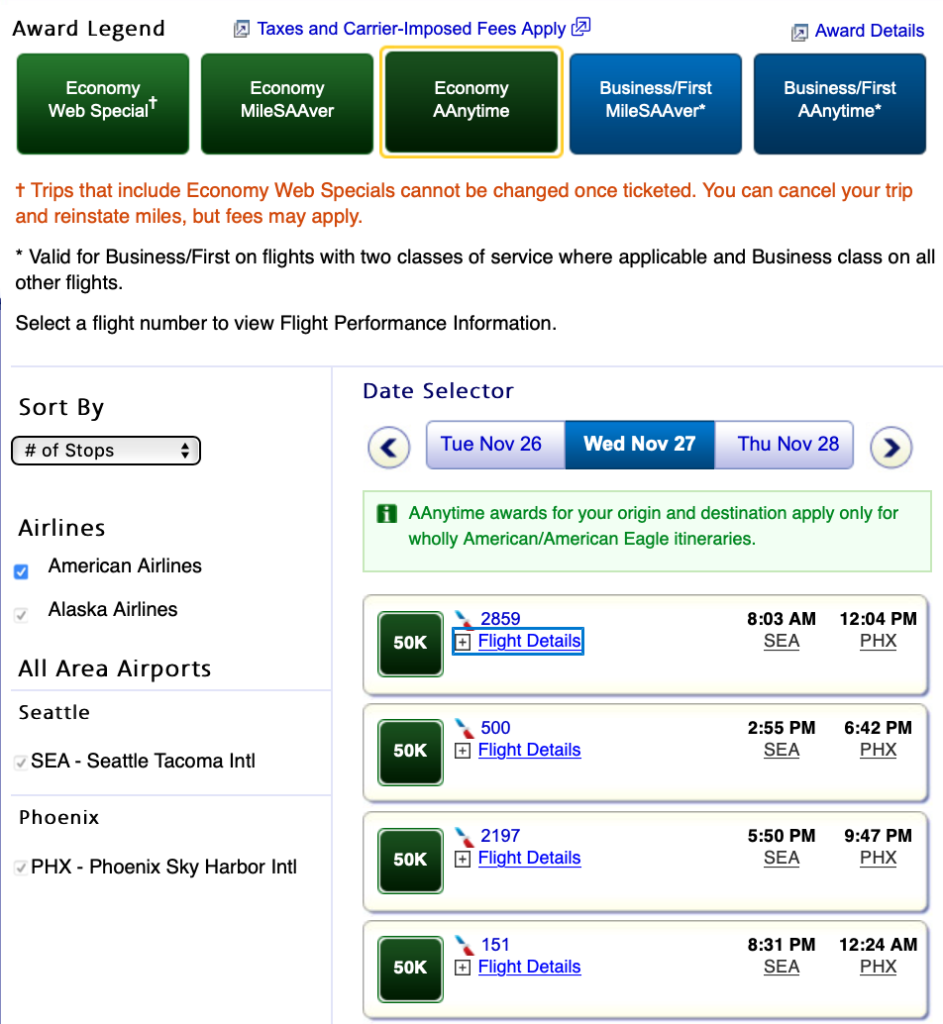

This truly is where the problem lies. If I were to jump over to American Airline’s website right now and look for a flight, what can I find for 50,000 miles? Let’s assume that the bank wants to charge me 1 cent per mile, so a total of $500.

Here’s a flight, tomorrow, on American Airlines from Seattle to Phoenix. You can see that it is 50,000 miles.

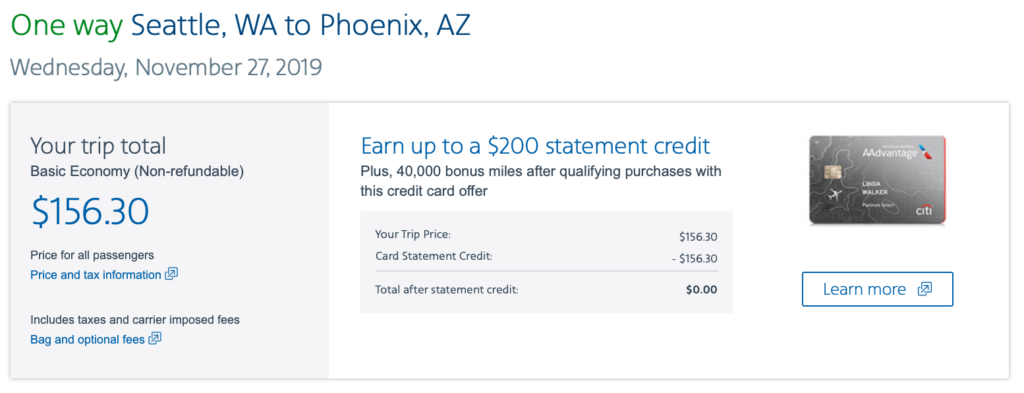

But, if you went to the American Airlines website to look at the cost of this ticket, you’ll see that the same flights are only $156.30. Does that mean that the cost of my miles is only $156? Or is it $500 because that’s what the bank says I should have got for it?

Previous Court Cases

Shankar v Comissioner

Back in 2014, Citibank sent a 1099 for Thank You points to a customer in New Jersey. The long and the short is that the IRS sided with Citibank in sending out the 1099 for points that he redeemed for a flight. Note, he redeemed the points for a flight that had value, they weren’t simply deposited into the account and then taxed.

Northwest v Ginsberg

In short, the courts ruled that frequent flier programs are not “prices, routes, or services†due to their changing nature. So, how can you put a price on something that intrinsically doesn’t have a price or a service?

So, what happens now?

I suppose this is the hurry up and wait portion of this post. Starting January 1st, we won’t have much of a choice. All of us who have BankDirect accounts are going to start getting these 1099 forms.

But if you don’t have a BankDirect account, should you be worried? I’d say yes, you probably should. The letter references “current tax law” which as far as I can tell, hasn’t laid out any changes to the frequent flier mileage programs… unless someone can find me something different?

If this manages to stand, what’s to stop American Express, Chase, Citibank, and other institutions from taxing these rewards as well?

I’m curious to hear some legal / tax professionals out there chime in the comments section below. What can we expect in the coming year from this?

November 27, 2019

This article is absurd. There is a HUGE difference between miles given out instead of instead on a bank account — that is plainly income — and miles given as a rebate to services you pay for (whether it be purchasing airfare, buying goods on a credit card, etc). It seems blatantly obvious that the IRS would tax miles earned as interest, but as they would tax dollars earned as interest.

November 27, 2019

But interest has a value of dollars and cents. Who is to say what the value is of an airline mile? Or a widget?

December 4, 2019

The bank is right here. The best measure of value would be what the bank pays the airline to buy the miles.

December 21, 2019

This is such a specialized situation and scenario that the title is, as someone else said, designed to be click-bait. Let me offer a correction to the title. Existing title: WARNING: Your Bank is about to Tax your Airline Miles. Corrected title: WARNING: My Bank is about to Tax My Airline Miles.

I know of no other bank that pays interest in miles, Famous Amos Cookies, or Reese’s Peanut Butter Cups.

This article is of severely limited scope.

December 22, 2019

Limited scope as it may be, that doesn’t mean it shouldn’t be talked about. Alternatively, I would accept Famous Amos Cookies 🙂

November 27, 2019

first line should be “instead of interest”

November 27, 2019

Click bait crap. Interest on checking account was always taxable. Doesnt matter what currency that interest is paid in.

November 27, 2019

Spot on!!!

November 27, 2019

Thanks for your invaluable comment debit 🙂

November 27, 2019

Jon, thank you for your click-bait nonsense!

November 27, 2019

Thanks Ron for your comment! We value and appreciate your read and look forward to serving you with another quality post in the future.

December 4, 2019

Doubt if this is click-bait. I also doubt that it’s a viable procedure for a bank. I’d bet that some idiot thought this up and the bank will see the light after all hell breaks loose. The IRS would be the final arbiter on this, not a bank associated with AA. I appreciate the heads up.

December 4, 2019

Absolutely! We just wanted to share the info as soon as we found out.

December 4, 2019

I am calling bs too. “Your bank” is NOT getting ready to “tax” your miles. Maybe this ONE particular bank is going to send out 1099’s for miles earned through their institution but that is all. Just do not open an account through Bankrate. I will worry only if things actually happen. Worry about potential problems is nonsense.

December 4, 2019

I think we should worry about potential problems… if you don’t, that’s your choice.

May 25, 2021

This is why you shouldn’t take tax advice from an article on the internet. Interest income is taxable and you cannot avoid taxation by collecting interest in points or miles – the ambiguity about reportable fair value is the reason why it’s so rare to see that offered and why it’s such a bad idea.

November 27, 2019

My understanding of this situation is that the miles are taxable because they are treated effectively as interest. You receive miles in exchange for making a deposit with the bank. So you are receiving something of value for the bank getting to use your money which as the court in the cited case says is the definition of interest. How much are those miles/points worth? If you read the case you cited the burden fell on the taxpayer who seemed to me very disorganized and made no attempt to counter Citi’s valuation and so obviously lost. The guy’s wife did not show up for the case and he claimed he did not know anything about getting thank you points or redeeming points for a ticket!

As to credit cards, miles have been treated as a rebate on a purchase and hence the IRS has not treated them as taxable. It is always possible guidance or tax laws can change but I have not seen anything to suggest that such a change is imminent.

December 4, 2019

BankDirect charges $144/year for the account. Perhaps the miles are a rebate of their service fee.

December 4, 2019

That wouldn’t be the worst…

January 2, 2020

This right here. Miles given in exchange for holding a balance or otherwise providing a benefit to a bank (e.g. referral bonuses) are taxable as interest. A few points I’d like to make, in general:

1. If miles earned from transactions are rebates, in the case of business accounts, that effectively reduces your business expenses. Are y’all taking those into account in your bookkeeping and tax returns? 😉

2. The document specifically says that no decision was made as to whether the earning of ThankYou points was the taxable event. So it’s somewhat debatable whether the issuance of 1099-INT as they are awarded – as many banks are doing now for referral bonuses – is justified. I guess we have to wait for someone to refuse to report it and contest it in court to get a final answer… unless there’s already a court case deciding one way or the other that I/we don’t know about?

3. With respect to (2.) – in some cases, you can lose your ThankYou points. Does that count as a business loss, if a business account? What about a personal account, does it count as forfeiting previously earned compensation, or an adjustment to a prior year’s income?

4. With respect to the valuation at redemption, and as a corollary to (3.) – if redeemed for more than the original estimated value, is one expected to report an adjustment to the prior year? Or additional income this year (akin to capital gains)? Or nothing at all?

5. Say one redeems 60k taxable (whether because it’s a business account, or because it’s interest) miles for an award ticket, the cash fare for that flight being $900. The alternative is a $600 cash fare on another airline, unavailable through the FF program (or fixed-value points scheme) you used. The steamboat example in the document points to that being worth $600, not $900, because you wouldn’t have never paid $900 for that ticket. So if I declare that I’d never fly a legacy carrier but “have to” if I use points/miles, I can always quote the value as (miles on legacy carrier)/(rev. fare on LCC), no? Food for thought.

January 2, 2020

Correction to (5.) – should say (rev. fare on LCC)/(miles on legacy carrier), not the other way around.

November 27, 2019

I believe this very much matters on how the miles were earned.

Via travel and credit card, IRS has long viewed, based on the precedence you cited, miles as a form of rebate and not earnings, since you have to spend something to earn something. Therefore, they are not treated as taxable income.

However, as earning from a checking or savings accounts, this is closer to earning as interest payment than a rebate, which is similar to the Shankar decision.

The kicker here is now they will only send you a form 1099 only if the perceived value is > $600. According to AA, 100,000 miles has an approximate retail value of $1,990, which pegs it at $0.0199/mile. (https://www.bookaacruises.com/promotion/sweepstakes.do – see the ARV for first prize winners) This is probably a good guess of how much they value AA miles. Therefore, you would have to earn more than 30,000 miles from BankDirect in a calendar year before they’ll issue a Form 1099. Even after that, you can argue the actual value in your tax filing.

November 27, 2019

Exactly. As I showed, 50,000 miles only has a value tomorrow of $156.30 so I think that’s a good starting place. Much like stock options, they have zero value until redeemed.

December 4, 2019

You’ve cited a redemption cost for an AAnytime fare, which has more benefits than the “Basic Economy” fare that you quoted for the same itinerary. Apples and Oranges.

Second, you cite a redemption option that appears to have very poor value. It’s clearly not representative of the value that most people would strive for when redeeming miles. (Personally, I value my AA miles at approx $.014 ea, based upon past redemption history.)

Third, any “commodity” has a variable value. It’s understandable that the IRS must stipulate a means by which frequent flyer miles can be valued. One logical benchmark is the price at which the airline itself sells miles to the public, which often sits in a range of $.02 – $.03 / mile. As a separate reply suggests, with proper documentation, you can value the miles at something that more realistically approximates what you can realize from them, assuming a good-faith effort to redeem them for best value.

Bottom line, this article highlights an issue that recipients of promotional miles should be alert to. However, the discussion is neither balanced, nor particularly insightful.

December 4, 2019

Who says it has a poor value? If I really want to get to Phoenix, that is the only option for me on that day, and that’s what 50,000 points gets me. Just because it looks like it’s a poor value to you, doesn’t mean it’s a poor value for someone who’s grandmother just passed away and needs to go to Phoenix. Also, it’s not really apples and oranges when there are no other options for redemption.

December 4, 2019

Not exactly. $156.30 is the price for a BASIC economy ticket. 50k miles is for “standard” economy. Not and apples to apples comparison.

December 4, 2019

You’re missing the point. Whether it’s $156 or a standard redemption or a business class ticket, that is what 50,000 points gets me. I don’t have a choice to redeem 50,000 points for a basic economy. If that’s what American Airlines offers me to book something on that day, that’s the price. It should not be up to a bank to tell me what my miles are worth.

December 4, 2019

The best measure of the value is what the bank pays the airline for the miles.

December 4, 2019

BINGO. I wonder if they’ll share.

January 2, 2020

You’re supposed to declare all interest received, whether or not you received a 1099-INT for it. They just don’t furnish 1099-INTs or report your earnings to the IRS if <$600.

November 27, 2019

+1 debit

Interest has always been taxable. Miles earned from travel, credit cards, etc. has always been tied to amount you must spend to receive the miles, which makes it a rebate and therefore not taxable.

More than likely this smallish bank has been flying under the radar for years by not reporting this income and is now just coming into compliance.

November 27, 2019

Miles earned via bank accounts have been taxable for years (as opposed to miles earned by flying or credit cards). If you’ve ever opened a Citi bank account with 50K promo miles, they have always sent 1099s for those.

Not to mention that interest on bank accounts has ALWAYS been taxable. Changing the currency that interest is paid in doesn’t change the tax status.

I think you’re gonna be out of luck here.

November 27, 2019

Agree with ptahcha. I am quite frankly surprised they did not send you a 1099 before. Chase and Amex have been doing it for a few years now that they tax you on referral bonuses (I believe if you’re over $600 i.e. 60k UR or MR) because those are considered Misc. income. And like ptahcha said, interest is considered taxable income by the IRS and this is why I am surprised your bank hasn’t send you a 1099 before.

November 27, 2019

“My Bank” isn’t going to do this anytime soon but this is interesting. I wonder if you could also claim a loss on your taxes when they devalue 🙂

November 27, 2019

Oooooooo. I like the sound of that!

November 27, 2019

Earning miles instead of interest from a bank is no different than getting a toaster instead of interest, and the IRS has always insisted that the value of the toaster requires a 1099.

November 27, 2019

But a toaster has a defined value. Miles do not.

November 27, 2019

That doesn’t mean you can’t find a reasonable value and use that. The cost of the miles paid by the bank would probably be a good place to start. Interest (whether paid in cash or non-cash) has always been taxable income.

Having to pay taxes on these accounts is annoying because it makes the miles worth a lot less, especially if you disagree with the bank’s valuation and have to deal with that. I honestly would spend my time focusing on other things.

November 27, 2019

Also, I was under the impression that no 1099 should be issued if the value is under $600. I wouldn’t be surprised if the bank is trying to do this so they can write the miles off on THEIR taxes and pass that cost on to us, the consumer.

November 27, 2019

A 1099 is not required, but may be issued.

December 4, 2019

Any legitimate promotional expense is deductible against business income. Reasonably so. I’ll never understand why some are inclined to suggest that this must involve some type of “scam”, or in some manner seeks to unfairly take advantage of “us, the consumer”.

November 27, 2019

In this instance the critical issue is that the mileage earnings are based on deposited balances and take the place of monetary interest. Therefore the bank must be purchasing these points or otherwise arriving at a value to entice deposits and backing into an interest rate equivalent and that then leads to a presumption of wealth transfer and hence taxable income.

It’s really a different, but related, tax discussion. Also referencing a 2002 IRS Publication is not useful and should not be relied upon for direct support.

November 27, 2019

Well, I would also say that they have relied on that since 2002 and not changed anything since so… I’d argue it is relevant.

November 28, 2019

Given that we will likely have a new Prez in 2020, I am more bothered by tax increases overall that have a macro negative impact on the entire country (less consumer spending, investment, etc.) than a tax on FF miles issued by banks that impact a relative few.

November 28, 2019

I’m concerned about a new presidency as well (more concerned about a current one being extended) but if this is allowed to stand, then it could have overarching implications for the entire FF system

December 4, 2019

I would take my money out of this bank and move it to another entity

December 4, 2019

Time for a new bank.

December 4, 2019

Poor take. You should have consulted someone like myself about it. There is a large difference between earning them on a bank account versus as a rebate for a transaction

December 4, 2019

Happy to consult with you on this! Message us.

December 4, 2019

SOLUTIONS :

1)CHANGE YOUR BANK

2)DON’T ACCEPT MILES IN LIEU OF INTEREST.

December 4, 2019

BS clickbait article. I wish I had the last 10 minutes of my life back.

December 4, 2019

I wish I hadn’t spent the last 10 seconds of my life responding to asshats comments but here we are…

December 4, 2019

In 2009 I won a contest with United and was awarded 250,000 miles and a bunch of first class upgrades and various other passes. The problem was that I was already a Global Services member so only the miles were worth anything to me. As such, come tax season United sent me a 1099 from Tinsdale & Associates public accountants and estimated the value of the prize package at around $7000. I was floored! However, speaking with other people who won on Flyertalk.com they advised to devalue the 1099 for the redeemable value of the miles with flights at the time of receipt of the miles. So, when I did this (and saved screenshots of the flight estimates) I was able to devalue the 1099 to around $1200. About 1 year later I get a letter from the IRS. They said I didn’t claim the 1099 from Tinsdale & Associates and filed a claim against me. I appealed and the IRS had a mediator call me to discuss this matter instead of going to court. I explained my situation to the agent and told him that a). United claims that miles, upgrades and passes have no intrinsic cash value and therefore cannot be sold, bartered or transferred for gain, b). The upgrades and passes were not of any benefit because I was at the highest level in MilesPlus and got these services for free anyways. The agent concurred and gave me a redress number and said the case was dismissed.

In summary, do a flight comparison as the article suggests and save that value. When tax time comes, devalue the 1099 and claim that adjusted value on your taxes. Be prepared for the IRS to contact you and explain your reasoning. They will agree with you and drop the case. I know this is a pain to do but it is the proper way of doing it. I hope this helps.

January 26, 2021

Yep, just got 1099 from Citibank. Opened saving account with the required deposit. Gave 20,000 miles so now I have to pay $190 tax:(

February 2, 2021

Citi Bank just sent me a 1099 for $380 for the miles they gave us.