Pay up to $72,000 in Bills (including rent) for Free with Plastiq

Paying certain bills like your cable, internet, and telephone are easy to do with a credit card. Simply set up your bills on autopay and you’re good! But earning miles with other bills such as the mortgage and rent has always been more elusive. Plastiq was started a few years back and since then has been THE best way to hit minimum spends on credit cards and pay your bills at the same time. They’ve launched a promotion for the end of September offering up to $72,000 in fee free payments depending on what type of bills you’re paying.

Plas-tique

A few years back we wrote about how we pay our rent with a credit card. Ever since then we’ve been paying our rent and other bills (like the landscaper, contractor, etc) via Plastiq when they don’t accept credit cards. When you sign up as a new user, you’ll earn $500 of fee free dollars to pay your bills. The only downside to doing it more often has been the fee associated with it.

Plastiq Expense Opportunities

Current Fees

Currently the fee to pay a bill is 2.5% for use of your credit card. You won’t want to use this for daily use, however, because more often than not, the fee is more expensive than the benefits that you’ll get. For example, on a $2,000 rent payment, you’d pay $50 but only earn 2,000 airline miles or hotel points. For me, 2,000 miles or points are not worth the $50 fee.

Promotions

Very often, Plastiq will run promotions dropping the fee down to 1% or sometimes even free. There’s a promotion currently for Visa cards at 1% as they just launched the use of Visa cards for more payments on their platform. I’ll manufacture spending at 1% all day long for certain miles and points, as buying miles at 1 cent a piece is worth it in many cases.

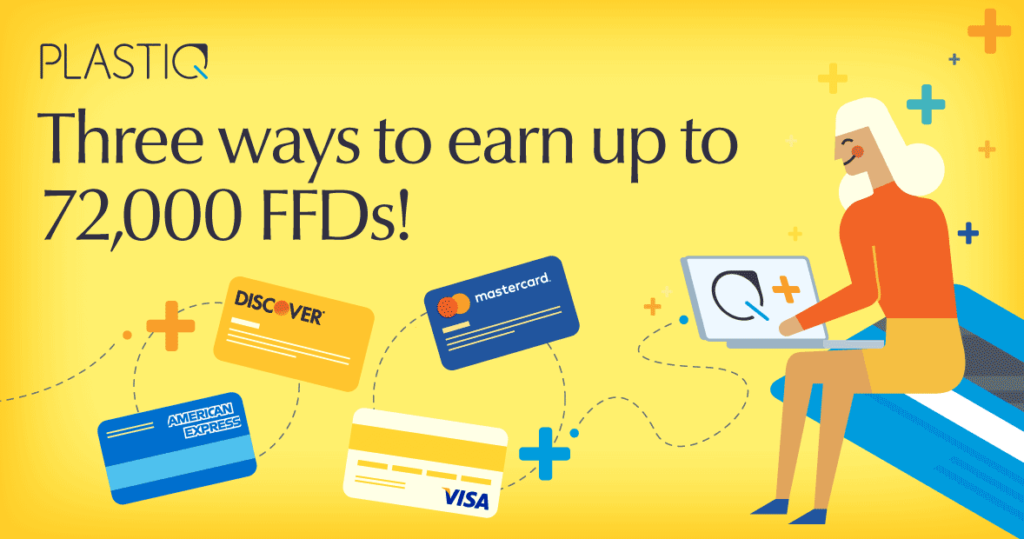

Currently, the awesome promotion is for up to $72,000 in fee free payments depending on how and where you send money.

- (1x) For domestic check, wire, or ACH payments: make a single payment of at least $2,000, and Plastiq will credit you 2,000 FFDs.

- (1.5x) For international payments: make a single payment of $20,000 or more to a new international recipient using our new service, and Plastiq will credit you 30,000 FFDs.

- (2x) For Forex payments: make a single payment of $20,000 or more via our Forex program, and Plastiq will credit you 40,000 FFDs.

One point to acknowledge about this promotion is that these payments must be made at the normal standard rate of 2.5%. With that said, you’re paying 2.5% up front and getting an equal amount back in FUTURE fee free payments. Considering that, you’re paying in the end 1.25% net for your payment. If you’re in the need to top off a balance on an account or you’re looking to pad your balance, 1.25% may not be the sexiest numbers out there, but considering it is manufacturing spend without leaving the comfort of your sofa and pajamas, this is a win.

This promotion does have a time limit, so don’t sit on this one for long:

- Eligible customers can submit immediate payments or schedule payments to be processed from now and before 11:59 PM ET on September 26, 2019.

Meeting Minimum Spend

One of the best ways to use Plastiq is to meet the minimum spend on credit cards. Often when you sign up for a new credit card (and here are the best offers, by the way) you will have to have a very high requirement to spend in the first 3, 4, or even 6 months. If you’re having trouble with your day-to-day spending, you can easily hit that number by using Plastiq to get there.

We used the $2,000 option because we had a very simple payment we needed to make to a contractor. For us to able to get those miles at 1.25% it saved us the hassle of running all over the place trying to hit a minimum spend.

How has your experience been with Plastiq? If you’re new, sign up using our referral link (we thank you in advance) and you’ll get your first $500 for free!

September 14, 2019

I would be interested in using Plastiq to make mortgage payments, but saw some reports saying Plastiq had problems coordinating payments to the lenders. That’s a deal killer for me, as a single missed or late payment can cause major damage to one’s credit score, which would more than offset the value of earning extra points.

September 15, 2019

Ours have always gone through. Of course, make sure it does before you just stop paying, but I suppose every mortgage provider is different

September 14, 2019

WTF!! clock bait GARBAGE you have to PAY the fee HOW IS IT FREE!!!!!! DANG.. i HATE bloggers

September 15, 2019

Wow Ryan – slow your roll. I never write clock bait, and you are of course, welcome to never read any of the bloggers on the internet ever again, but just remember that when we give you that amazing deal that you couldn’t have found out about anywhere else, that you got it from the HORRIBLE bloggers. Happy travels!

September 17, 2019

Ryan- I hear what you’re saying; I felt the same way. Always have to see the big picture. Pay 2.5% now, and when you have a need to MS, you’ve got $2000 (free- 0%) waiting for you to spend. All in all, it comes out to 1.25% for 4k spend. Also, if you do the 1st 2k on a 2% card, you’re almost even. MS’ers always have to determine what’s the best deal for them.

Good Luck!