My New Favorite Credit Card (for the next year)

Did you know that almost 30% of Americans have no credit cards? Those of us that do have credit cards have on average 3.7 cards at any one given time. I’ve made mention before that between the two of us we have about 17 different credit cards, and which one we use depends on our given mood, earning strategy, and desire for a certain points currency.

We’d been ignoring a lot of cards lately because it seems like we’ve got way too many miles and points (I know, what, wait, huh?!). In 2017 we earned just shy of 2.1 million miles and points, and in 2016 we earned almost the same. If you’re curious about how we did that, you can read up on it here.

Cash is King

Thanks to our huge cache of miles and points, we can pretty much go anywhere anytime that we want to without worrying about the cost. We’ll still earn miles and points just like we always have, but having cash on hand is never a bad thing. The problem? Most cards only offer 1%, 1.5%, or 2% on purchases at best. Some have rotating categories for 5% bonuses, but that’s the top of the mountain.

While many people want the aspirational trips to travel in first and business class, sometimes that’s just not attainable. They don’t have the stamina, wherewithal, or knowledge to go galavanting around looking for the best manufactured spend techniques to rack up 500,000 points in a month. Ya know, SOME of us do have lives after all!

Enter, Discover Card

Now just sit tight… because I know a lot of you are probably going to stop reading here, but just keep reading, I promise it’ll all be worth it.

I’ve had a Discover card since the early 2000’s. It was one of my first credit cards, they gave me a big limit, and constantly offered my 0% on balance transfers and purchases. It was my goto card in the financial crisis of 2008-2010 and it got me through some hard times. Once my financial situation improved, it got relegated to the office drawer with all the other credit cards that I never used.

Upgrade!

I got an envelope in the mail yesterday saying “we’ve upgraded your account.” Intrigued, I opened it and found that I was upgraded from my basic student Discover card to the Discover It card, and given all the treatment of a new account.

While there was no signup bonus (and still there is no instant signup bonus for the card) there was ONE little feature that stuck out in my mind, and that’s the feature that I’m going to talk about here.

Double Cash Back for 12 months

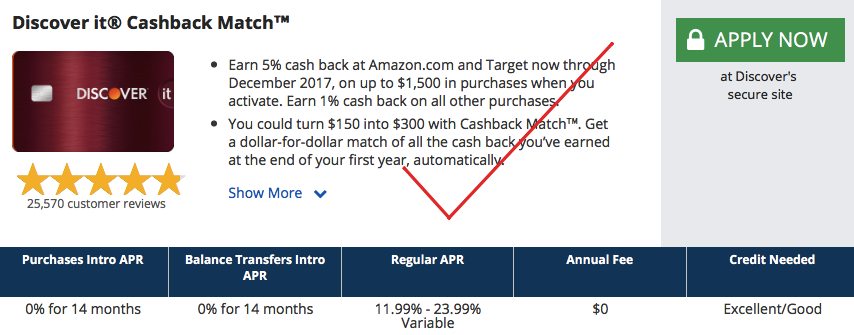

For the first 12 months that you’ve got the card, Discover card will double your cash back on WHATEVER you buy and whatever you earn. That means if you sign up today, then at the end of October 2018 you’ll get a fat check for the exact amount you earned throughout the year.

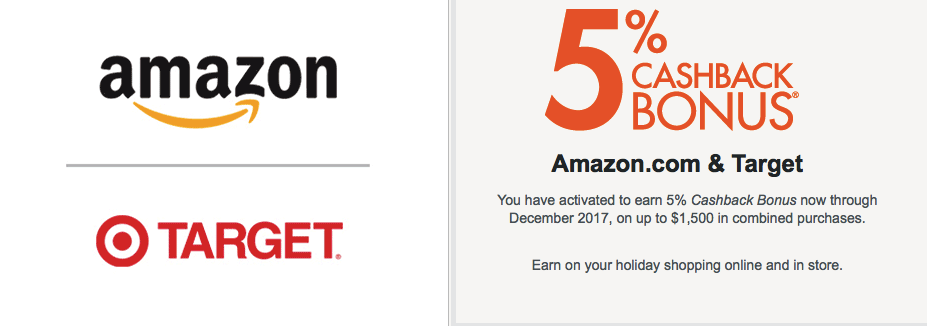

While Discover’s basic cash back is 1%, the card offers a really sexy and attractive cash back portal to earn a TON of rewards. They also offer quarterly promotions depending on where you spend. For example, from now until the end of the year you can get 5% cash back (oops, I mean 10%!) at all purchases from Amazon and Target, up to $1,500 in purchases. This INCLUDES gift cards. So, spend the money now, get $75 back, and in a year’s time, get a big ol check for $75 again.

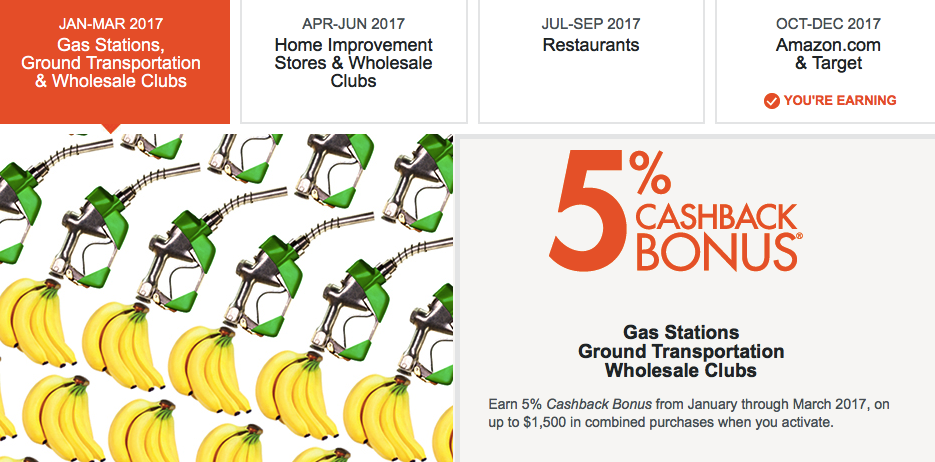

5% Bonus Quarters

Every three months the bonus changes. Here’s an idea of what 2017 had in store:

Gas Stations, Wholesale Clubs, Home Improvement Stores, Restaurants, etc… easily you could earn $300 a year (which means another $300 in a year’s time).

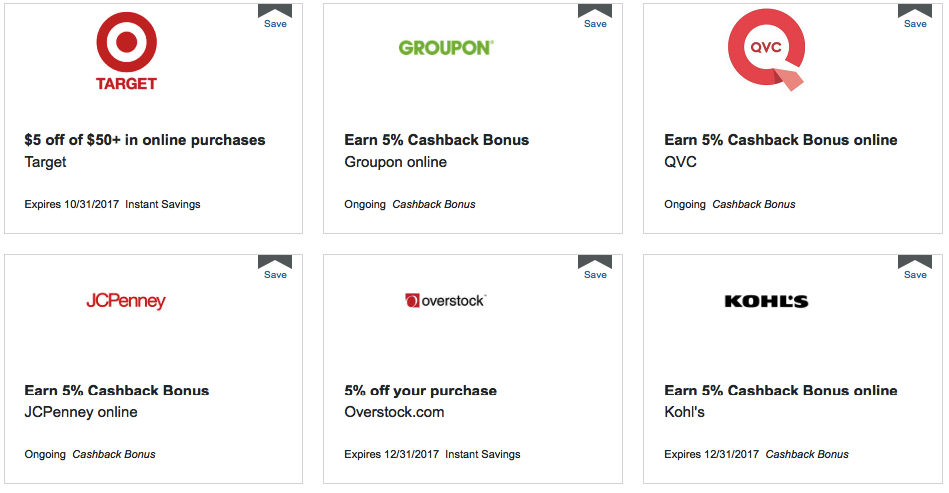

Shopping with Discover

If an extra $300 doesn’t sound too exciting, just wait. They’ve also got their own online shopping portal with bonuses ranging from 5-20% cash back! We just bought some things for our house from CB2 and sure enough, just after the purchases we got a healthy 5% back into our account. Simple as that!

They also run targeted promotions. Back in 2015 when Discover and Apply Pay teamed up, you could get 10% cash back on all your purchases up to $10,000. If they decided to run something similar this holiday season, that could mean as much as $2,000 in rewards for you! Are you starting to see how this could all add up?

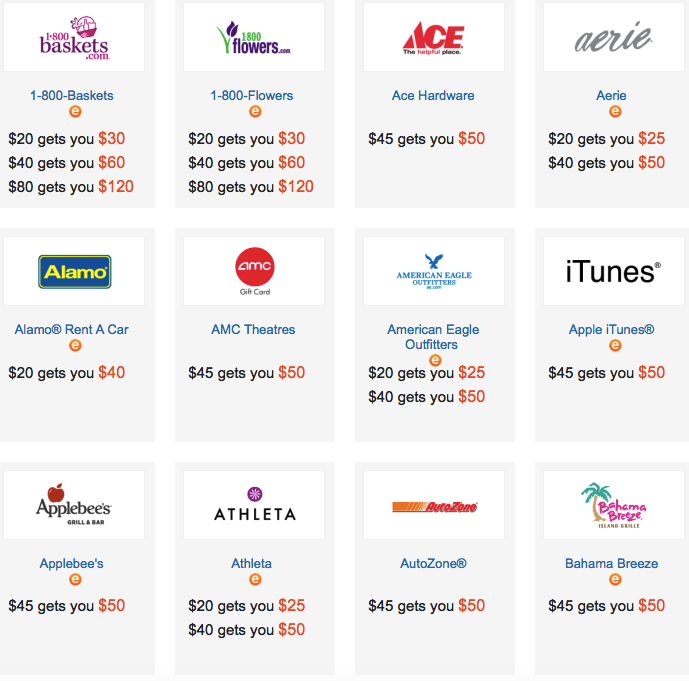

Extra Bonus Redemption

When you go to redeem your Cashback Bonus, Discover will offer you an extra bonus if you choose gift cards as well. Typically this is an additional 10-20% in value, and at a minimum is $5 on each card. The Gap family of brands, for example, adds 20% to the card value. So if you’ve earned 10% on purchases, 20% on the gift card, and another 5% back when you buy through Discover’s portal, anytime you shop at Gap/Banana Republic/Old Navy, etc, you’re getting 35% back.

WOW!

How to apply?

Applying for a Discover card is easy, and typically approvals are easy to come by as well:

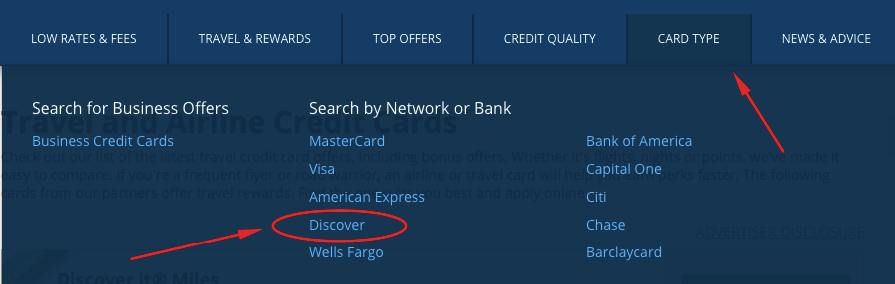

- Click the Credit Cards link at the top of our page. This will take you to our credit card page where you can apply for the Discover card or any other card your heart desires

- Click here if you don’t want to scroll all the way up (ya lazy bum!) 🙂

- There’s a link at the end of our post as well.

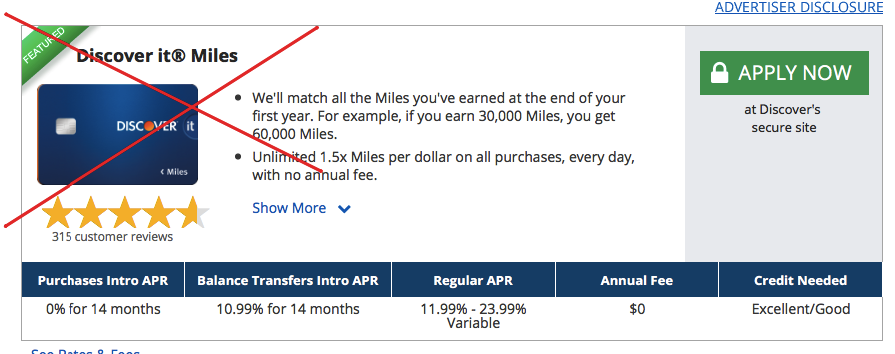

When you go get to the page, head to the top of the page, but don’t be fooled. DO NOT choose Discover Miles. It’s a horrible card in comparison and doesn’t give you the cash back double offer.

This is going to be our new go-to card for all of our online purchases, especially if there is a 5% (I mean 10%) bonus involved. Like I said, we’ll still have all the other cards for our airline mile and hotel point earning, but for everything else, welcome Discover. You’re in my wallet now!