How To Get A Credit Card As An Expat

The problem

Moving to another country is an exciting time. However, it can also be very stressful. You have to worry about finding a place to live, making new friends, and figuring out how everything works in an unfamiliar environment. Figuring out your credit card situation is probably pretty low on your list of concerns.

After all, you probably have at least one credit card with no foreign transaction fees. These are great if you are on vacation, living out of the country short-term, or getting paid in USD. However, chances are if you’re moving out of the country for more than a year, your employer is likely going to pay you in the local currency.

You could receive payment in a foreign bank account and transfer funds back to your US account, but transfer fees are typically higher than the rewards on your card. You still want to earn credit card rewards though, so what do you do?

First Steps

The first thing you need to do is establish a bank account in your new country. If your employer is moving you to the new country, they will usually help you setup an account prior to moving. If you aren’t moving through an American company though, chances are you’re on your own. Some countries can make setting up bank account very difficult for expats. In the UK for example, you must have a proof of identification (passport) and proof of address. It sounds simple, but when you consider that you must have an original utility bill for proof of address, it can be difficult.

Once you’ve found a place to live, setup your utilities immediately. This helps get the ball rolling on getting a bank account open in your name. Make sure that the bill is from one of the main utility companies (water, gas, electric). Many banks will not accept cable or cell phone bills. We setup the utilities in my fiancée’s name and the phone bill in mine. That made getting a new account a nightmare. If you’re living with someone else, learn from my mistakes and just put one utility in each person’s name.

Another option for setting up a foreign bank account is using a digital or mobile bank account. A few popular options in Europe include Monzo, Revolut, and Monese. Most mobile bank accounts are very easy to setup, and don’t require much proof aside from a photo of your passport. Keep in mind that not all mobile banks are secured by depository institutions, so they may not be the best option if you plan to hold large amounts in your account.

If it seems like I’ve spent a long time talking about bank accounts, it’s because it’s important! You won’t be able to get or pay for your new credit card without it. Even if you don’t plan to get a credit card in your new country, it’s still a critical first step for getting your financial house in order.

You have a bank account. Now what?

Now that you’ve got your bank account setup, you probably think it’s time to apply for a credit card in your new country. Hold on though – like in the US, you need credit history to apply for a card. If you’re just moving to a new country, chances are you have little to no credit and will have trouble getting approved for a good rewards card. What can you do?

Enter Amex

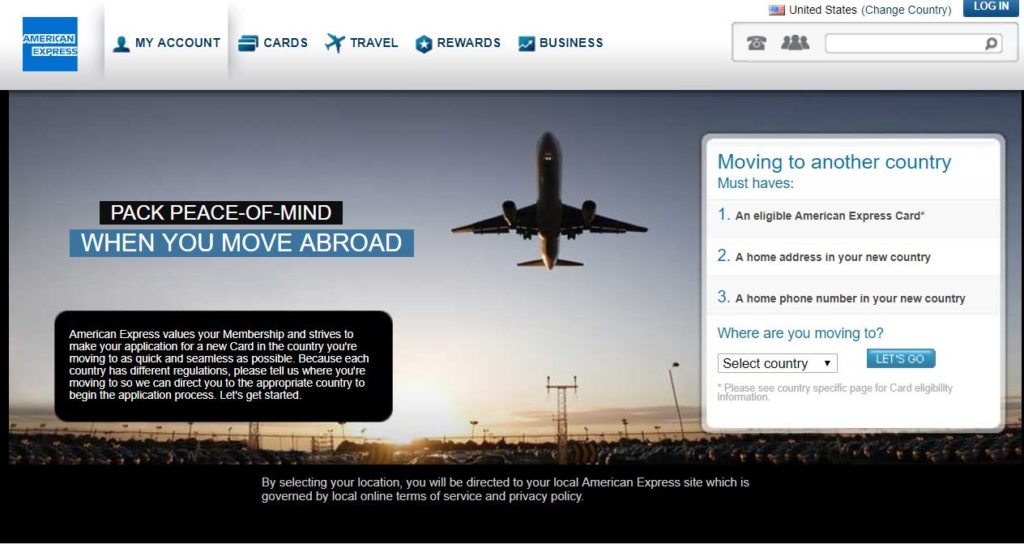

Thankfully, American Express has an answer to your problems – the American Express Global Card Transfer program.

Thankfully, American Express has an answer to your problems – the American Express Global Card Transfer program.

The American Express Global Card Transfer program allows any American Express cardholder to use their existing Amex credit history to apply for an Amex card in their new country. In order to take part in this program, you must have an eligible American Express Card, a home address and phone number in your new country. Travel rewards cards cards such as the The Platinum Card from American Express, American Express Gold Card, or Blue Cash Preferred Card from American Express should all be eligible.

If you’re moving to one of the following countries, you’ll be eligible for the Global Card Transfer:

- Argentina

- Australia

- Austria

- Canada

- Finland

- France

- Germany

- Hong Kong

- India

- Italy

- Japan

- Mexico

- Netherlands

- New Zealand

- Singapore

- Spain

- Sweden

- Taiwan

- Thailand

- United Kingdom

- United States of America

It’s important to note that you will still have to apply for the new card. However, if you have maintained good credit back home, this shouldn’t be an issue.

American Express’ terms and conditions state you will not be eligible to receive the welcome bonus if you’ve already earned it for that card. However, there have been reports of people still receiving the bonus in the new country so YMMV.

It’s also important to note two key points:

- The reward structure will differ based on the country

- Points will accrue in a separate Membership Rewards account

You will also want to make sure have your existing American Express card open for at least three months before you’ll be eligible to take advantage of this program. If you’re planning on applying for a card before taking part in this program, you can see what options American Express has available to you here. Generally speaking, personal cards should be fine, though small business cards are country dependent. To see which cards are eligible, click here. Select the country you plan to move to from the drop down and check the notes at the bottom of the next page.

Per American Express’s terms:

To be eligible for a new Card in the country you are moving to, your existing Card must be issued by American Express, you must be the primary Cardholder, and have held the Card for at least 3 months. Your Card Account must be open and in good standing at the time of your application. If the Card was previously cancelled by you, it must have been cancelled within the last 3 months. American Express Corporate Cards and American Express Cards issued by Banks other than an American Express Bank are not eligible through this Card application process.

Some other important things to consider

- If the new card carries an annual fee and you decide to keep your US card open, you will be responsible for paying both annual fees. For example, if you currently have an American Express Gold Card in the US and open up the same card in the UK using the Global Card Transfer Program, you will be responsible for paying the annual fee on both the US and UK Gold Cards.

- Your foreign American Express card is likely to be less rewarding than the US version. While part of what makes the US cards so attractive is their earning structure, credit card rewards are far less lucrative outside the US. Welcome bonuses, category bonuses, and other perks will vary depending on the country. For the most accurate earning structure, be sure to check out Amex’s site for that country. Still, earning points is better than earning no points. By the end of our first card year, we’ll have earned over 50,000 Membership Rewards points. In addition, though our card doesn’t earn as much on bonus categories as in the US, we’ll still receive a 10,000-point bonus upon paying the annual fee this year.

- Your foreign Membership Rewards points are separate from your US Membership Rewards points. Therefore, it’s important to make sure you spend or transfer your points before leaving the country and closing out the account. However, you can transfer points from both Amex Membership Rewards accounts to the same frequent flier account.

- While many partners are the same, American Express transfer partners may vary slightly depending on the country. Transfer bonuses may also vary. For example, there is currently a 40% bonus on points transferred from US Amex accounts to British Airways. However, the UK site does not have a transfer bonus currently.

Final Thoughts

Overall, we’ve been very happy to have this option. This is something I wouldn’t recommend unless I thought it was worthwhile. The entire process was pretty simple and within two weeks, we had our new cards. The American Express Global Card Transfer Program has been a great way for us to continue earning points while living abroad.

September 2, 2019

Very good article. I’d love to retire abroad and this information is helpful.

September 3, 2019

That sounds like a fantastic goal! Good luck, Adina!

September 3, 2019

Thanks for this in-depth explanation of the credit card process in a foreign country.

My question however is,why can’t I continue to use my existing US based card account as long as I’m making the payments?

September 3, 2019

You certainly can do that. However, if you’re working in a foreign country and getting paid in that foreign currency on a long-term basis, they’ll require that you have a bank account in that country. With money only going out, chances are your US-based bank account is going to dry up eventually.

You could transfer money from the foreign account to your US account to pay the bills, but the costs to transfer money over negate any additional earning opportunities.

September 24, 2019

Great post! Thank you!

Here’s an interesting quest though: what if I moved overseas many years ago, built my relationship with Amex overseas but closed all my accounts in the US (noob mistake I guess), can this be done in reverse to restart my relationship in the US one my next trip back to the States? 🙂

September 24, 2019

We all make mistakes. As long as you learn from it 🙂

This program works both ways so it shouldn’t be an issue. However, if you do have any issues, call the Global Transfer team and they should help you sort things out. HEre’s a link to the US application if you need any additional info. Amex Global Transfer US Application

August 7, 2020

Sadly the global transfer page did not provide anything special for moving from the US to India. It opens with a regular external application page where I applied with no response. When I applied again they rejected the second one saying I had one application in 90 days already.