How I Bought my Tesla with Gift Cards

It’s long been a dream of mine to own an electric vehicle, and I’d like to say it’s only from an environmentally conscience perspective, but it’s mostly because it’s the closest I’ll ever get to piloting a space craft.

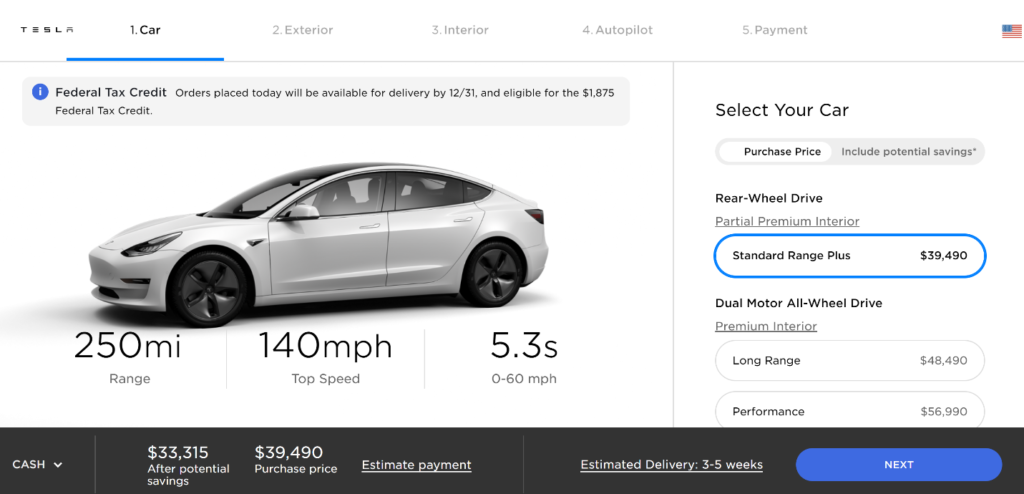

White Tesla from Tesla’s Website

White Tesla from Tesla’s Website

But if there’s one rule in our household, it is that nothing -absolutely nothing- gets purchased without earning miles or points out of the transaction. Of course the first thing I did when I got interested in a Tesla Model 3 was to ask about the possibility of putting it on one of our credit cards. I had been religiously saving for a few years, so I had the money comfortably sitting in my bank account but I wasn’t willing to just write a check and leave all those miles and points on the table. That would be dumb.

After doing some research and getting extremely frustrated with the utter impossibility to do any serious mileage earning off this purchase and just about ready to quit this quixotic task, it dawned on me that nothing worth having is within easy reach. The answer was to turn something mundane and easy into a complex, roundabout activity to squeeze more juice out of the same oranges.

Tesla Checkout from Website

Tesla Checkout from Website

The sticker price of a Tesla model 3 is $39,490 for the most basic model without any bells and whistles (not true, the most basic Tesla is a treasure trove of bells and whistles, but I digress). Tesla only allows you to put down a $2,500 deposit on your credit card to secure the delivery of your car. That left $36,990 I needed to get some points from.

Challenge Accepted

The easiest way to do this, would have been to go to an online bill pay service such as Plastiq (if you’re not on it already, here’s a referral link with which you will get your first $500 fee free), choose my preferred credit card and earn the points. However, this comes with a high percent fee being added to the overall cost. Depending on promotions, I would have paid between $739.9 and $1,109.7 in additional fees if I used a credit card to pay directly through this service, considering their standard 2 to 3% fee. I wasn’t having it.

Since I didn’t want to run into additional costs, for the purposes of this challenge, I settled for a maximum of $200 in surcharges and fees in exchange for earning the most amount of miles and points possible. In order to do that, I decided I couldn’t go with a credit card that only earned one point for every dollar spent.

Plastiq’s Welcome Site

Plastiq’s Welcome SiteI could have easily paid with an airline card and earned 35,000 airline miles or even a hotel card and earned 35,000 hotel points. It was time for me to take a look at what I had in my wallet and see what options I had that earned me more than that.

Credit Card Options

First, the American Express Gold, which earns 4x Membership Rewards at supermarkets. This benefit here being that anything you purchase within the confines of the walls of the supermarket earns 4x membership rewards points.

Second, the Hilton Honors American Express Surpass, earning 6X at grocery stores. Much along the same thread as the Amex Gold, but as with all things in the points and miles space, diversification is key. Since this card also earns 6x Hilton Honors points at supermarkets, I could also top off my Hilton balance for some hotel stays.

Finally, the Chase Ink Business Cash, which gives you 5X at office supply stores. Once again, anything you purchase within the confines of the office store (like a Staples or an Office Depot) will trigger that 5x Chase Ultimate Rewards bonus.

As an honorable mention, another interesting card would have been the American Express Blue Cash Preferred, which earns you a 6% cash back at supermarkets, but since I don’t currently have it and I’m not in the market for another credit card, I ended up not pursuing it any further.

Buying a Tesla at a Grocery Store

Sorta. A few months ago, my local Safeway (Albertson’s, Vons, etc.) ran a promotion where you were able to get a $500 MasterCard gift card for $10 off. What this meant was that I could get $500 for $495.95, since the $10 off partially offset the activation fee. Picking up a few of these using my cards was a great way to earn multiple thousands of points. Each of these cards would earn me somewhere between 2000 to 3000 points.

Safeway Gift Cards

Safeway Gift CardsEach 495.95 purchase on my American Express Gold earned 1,983 membership rewards or the Hilton American Express earned 2,975 Hilton Honors points. I decided to get 25 on my Amex Gold and 25 on my Hilton card. This way I could have both currencies and top off my balances.

Buying a Tesla at an Office Supply Store

Again, sorta. Over the past several months, both OfficeMax and Staples have been running promotions for fee-free gift cards, meaning you can get $200 Visa/MasterCard gift cards for exactly $200, so there’s no additional cost to buying these gift cards.

Staples Gift Cards

Staples Gift Cards

Normally, these $200 MasterCards come with a $6.95 fee. Being able to avoid that fee at the same time that I was looking to pay off the loan was happy coincidence.

Since the Ink Cash offers 5 points per dollar at those office supply stores, each card would signify 1000 points to grow my Chase Ultimate Rewards accounts.

Getting a Loan

Well, obviously we can’t just walk into a Tesla dealership with a stack of Mastercard gift cards, so we’ve got to find a way to liquidate those cards. Plastiq will allow you to pay off many banks (and in turn, auto loans) using debit cards for a low 1% fee.

Luckily, there are tons of banks in the world, and getting a car loan (especially for a new Tesla) wasn’t that hard.

Paying my Loan off with Plastiq

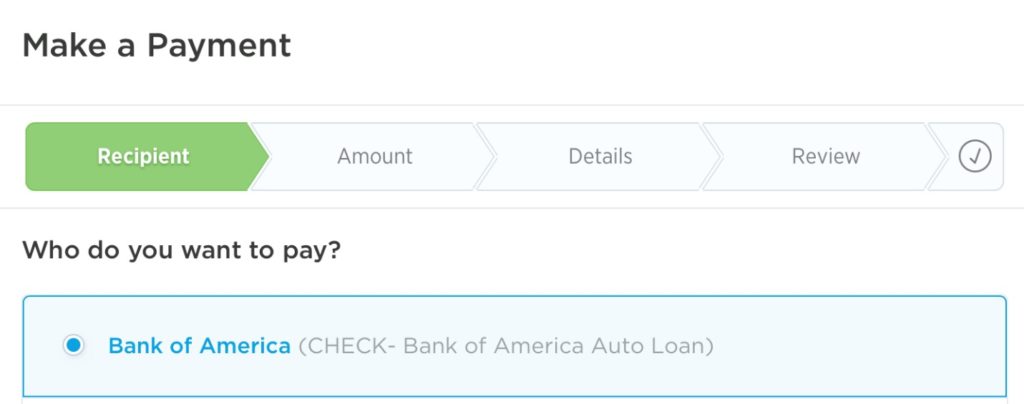

Since all of these cards are effectively debit cards, this is when Plastiq comes into play and makes a lot of sense. Most banks have electronic payments set up with Plastiq, so it was an easy set up to link the accounts. Let’s get into the math.

Plastiq Make a Payment

Plastiq Make a Payment

Breaking Down the Math

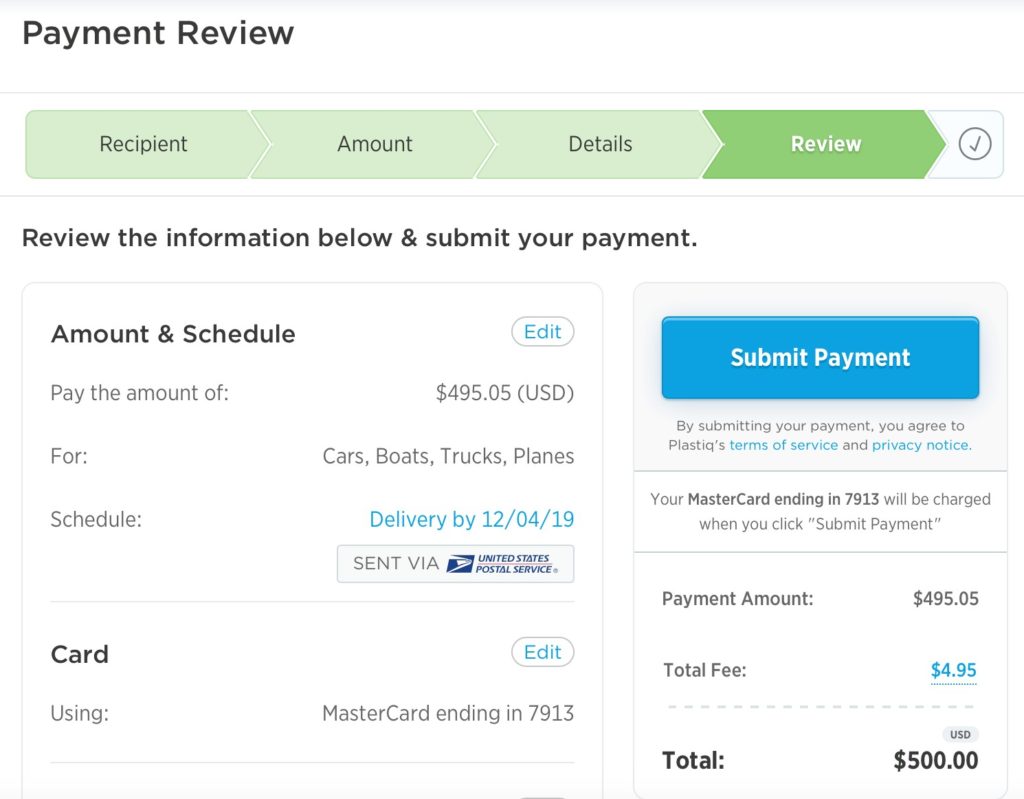

Gift Card at Grocery Stores $495.95

Plastiq Bill Pay Fee $4.95

Out Of Pocket Cost $0.90

Since Plastiq charges a 1% fee, I sent out $495.05 + the $4.95 fee making each charge exactly $500, wiping out the balance on each card.

Plastiq Payment Review

Plastiq Payment Review

Plastiq Payment Sent

Plastiq Payment Sent

Gift Card at Office Supply Store $200

Plastiq Bill Pay Fee $1.98

Out Of Pocket Cost $1.98

We did the same for all the $200 cards. For each card I sent out $198.02 and Plastiq charged their fee of $1.98, making the total charge to the card $200.

So, to make this all happen I ended up buying fifty MasterCards at Grocery Stores (which pays off $24,752 off my loan) at a total overall cost of $45. For the remaining $12,238 of the loan, I purchased 62 gift cards at office supply stores at a cost of $124 in total. If you’re good at math -which I’m not- that all added up to $169 out of pocket expenses.

What I Earned

Amex 49,595 MR ($495.95 x 25 cards x 4 points per dollar)

Hilton 74,392 Honors Points ($495.05 x 25 cards x 6 points per dollar)

Chase 62,000 UR ($200 x 62 x 5 points per dollar)

So, whereas I would have only gotten only 2,500 points by just getting my reservation processed through a credit card, by going slightly out of my way, I managed to get 185,987 points and only spend $169 to do so.

Those 75k Hilton points will easily net us a two night stay at a Hilton property and those 111k Chase Ultimate Rewards and American Express Membership Rewards points will convert nicely over to the airlines at a 1:1 ratio, allowing me to book a round trip airline ticket in business class with no problem!

St Regis Maldives

St Regis Maldives

Ah, and before I forget… As you’ll notice in the picture above, all orders placed this year are earning the federal tax credit of $1,875. That’ll be a nice bonus in Q1 of next year when I file our taxes… yet another bonus for buying an awesome car. While it isn’t directly related to buying the car, or even earning miles and points, that’ll be a straight credit back on our taxes at year end, making the “profit” on this even better, and way more than just covering the actual cost of buying the gift cards.

Ps… if you are interested in the Tesla and snagging that tax credit before year end, here’s my referral link – you’ll get 1,000 miles of free supercharging and we will as well – thanks in advance!

Final Thoughts

As I mentioned in the beginning of the article, nothing in our household is purchased without the “can I earn some more miles and points” conversation, even down to the mundane daily shopping. When it came time for a large purchase, however, the process is obviously a little more involved.

While this might not be for everyone, and you might not be in the market to buy a Tesla, you can absolutely use the baseline information shared in this post and apply this to all things in your life.

January 9, 2020

Now an honest question, why did you use the Hilton card instead of the Gold card for half the transactions? Or did you really just do it to top off your Hilton balance?

Asking because if latter was the case, you could have just purchased everything with the Gold card and transferred it to HH at 1:2 ratio, making it 8 HH points/$ instead of 6. That’s 25,000 HH pts more…

January 9, 2020

That sounds great – I wonder if there is anything similar in the UK that people can do?

January 9, 2020

Thanks, Leanne. I honestly don’t know, but I suspect there aren’t great deals like this outside of the US. Might want to ask local bloggers like God Save The Points, or From Miles to Smiles, or Head for Points, they might be more aware of local nuances.

January 9, 2020

Gift card activation fee + 1% platiq fee for using a debit card? So basically 2% charge except when you got them fee free? Definitely worth it when you are getting category bonuses. I might have to do this myself to pay off some cars 🙂

January 9, 2020

@klanfa

The gold card has a limit of $25K in Grocery for 4X earnings. He might have hit the limit

January 9, 2020

I honestly wasn’t concerned with how to maximize to the extreme, I bought these cards slowly but regularly every time I happened to go to a grocery store for food or office supply store for business purchases. Just like with everything, moderation is key.

January 9, 2020

I’m absolutely impressed.

January 9, 2020

Interesting considering Amex no longer earns points for gift cards at my grocery store.

January 9, 2020

Interesting. What grocery store is that?

January 9, 2020

Here’s an idea…

Why not buy those gift cards with a Sapphire or AMEX product, then transfer the balance to one that’s interest free on balance transfers for ~16 months? Then after 16 months if you haven’t paid your car off yet, transfer the balance to another interest free card? Wouldn’t this work?

January 9, 2020

Before folks rush out to try this, plastiq stopped taking prepaid mastercards on January 1st, 2020.

It’s not able to be replicated.

January 9, 2020

I was going to say the same. You can’t do this anymore.

January 10, 2020

Plastiq updated their fee page:

U.S. Debit Cards

Please note that the Plastiq fee for Visa, MasterCard, American Express, Diners, Discover, JCB debit card issued in the US is 1%. This excludes pre-paid cards, gift cards, online-only banks and all international debit cards.

Might still use it to pay the Property Taxes (California) for 1% in exchange for points.

January 9, 2020

What about the interest rate/fee on the loan. I missed that.

January 9, 2020

Didn’t factor this in as it would be different for anyone, but regardless, the point was to pay it off before it had the chance to accrue any significant interest.

January 9, 2020

Ben, how were you able to buy 62 $200 cards at Staples and office supply stores? The ones in my area aggressively adhere to the one per customer rule when they are running the no activation fees specials

Am I not charming enough?

January 9, 2020

We didn’t buy them all at the same time. Stores do adhere to that rule, the good news is that they run that promotion practically every month or every other month so there are plenty of opportunities to take advantage.

February 16, 2020

$40k for a compact car? Watse. Of. Money.

February 17, 2020

I have no need for a larger car, nor would I want one anyway. I’m getting exactly the use I intended so no waste whatsoever – literally!

February 17, 2020

LOL – just LOL

November 5, 2020

Nice job, thanks for sharing!