Bask Bank sending out 1099 Forms, and They’re NOT Bad

Back in November of 2019, we reported that BankDirect (now Bask Bank) was going to be sending out tax forms for their American AAdvantage miles that they give out in lieu of interest on their savings accounts. We were concerned because they never actually gave a monetary amount to those miles.

Just last week, both BankDirect and Bask Bank sent out to their account holders a 1099-INT form for the accounts, and honestly, they’re not as bad as they could have been. With that said, let’s take a look at the cost and you can decide if your money is best elsewhere.

The Letter

Ben received a curious letter in the mail (actual mail, not email) last year from BankDirect. For those of you that aren’t familiar with BankDirect, it’s based out of Richardson, TX, a suburb just north of Dallas. Since they’re so close to the headquarters of American Airlines, their bank is a little different. They’re now called Bask Bank and the way you earn miles is slightly different than before.

Instead of earning interest on your checking and savings accounts, you can earn American Airlines AAdvantage Miles. For every $1,000.00 of the balance in your checking account (up to $60,000) you earn 100 miles a month. That means that if you kept the full $60k in your account, you would earn 5,000 miles a month or 60,000 miles a year. Not a bad haul!

The letter that arrived, I thought, was a harbinger of bad things to come. Below is the photo scan of the letter but I’ve included the text here as well. Bolding is my own:

We truly appreciate your business and thank you for being a loyal BankDirect customer. We wish to inform you that under current tax law, we are now required to report to you and the IRS the value of miles you receive from BankDirect. If you receive miles from BankDirect on or after January 1, 2020, we will issue the appropriate form 1099 to you and the IRS in January of 2021. Since American Airlines AAdvantage miles do not have a defined cash equivalent and the value they represent is subject to various factors specific to each American Airline Advantage member, the amount reported will be based on our good faith estimate of the market value. The estimated market value can be impacted by numerous factors and may materially change prior to the issues of form 1099 each year.

BankDirect is not an account firm or law firm and does not provide tax or legal advice. Please consult with your tax advisor regarding the tax implications of this information.

We appreciate your trust and continued support.

SincerelyJason Martinez

Vice President, Manager

The Cost per Mile

It’s actually really hard for me to calculate the actual cost per mile that they charge, but from Ben’s 1099’s and my 1099, it is somewhere in the range of $0.003 and $0.007 cents per mile. That’s an average of a half a cent per mile.

The reason that I can’t say EXACTLY how much it is, is because when Ben and I took the amounts on the 1099 and divided them between the amount charged, no amount was precise.

Ben got a few more “bonus” miles than I did, and I got a few more “referral bonus” miles than he did, so it’s difficult to see exactly which kind of miles they’re charging interest on.

The “Worth It” Math

Let’s say that you earned the full 60,000 miles a year and you got charged a $.006 cent a mile, meaning you would get a $360 1099-INT form.

If you took that $60,000 a year and put it in a normal savings account, you’d earn a pittance, probably a few dollars at most.

You could try your luck in the stock market and maybe get a better return, but the true question is, what do those 60,000 miles get you for a cost of $360?

If you used those for a one-way ticket to South America in Business Class, that would be around 55,000 miles. So is it worth it for a one-way business class ticket to South America for $360? I’d say yes.

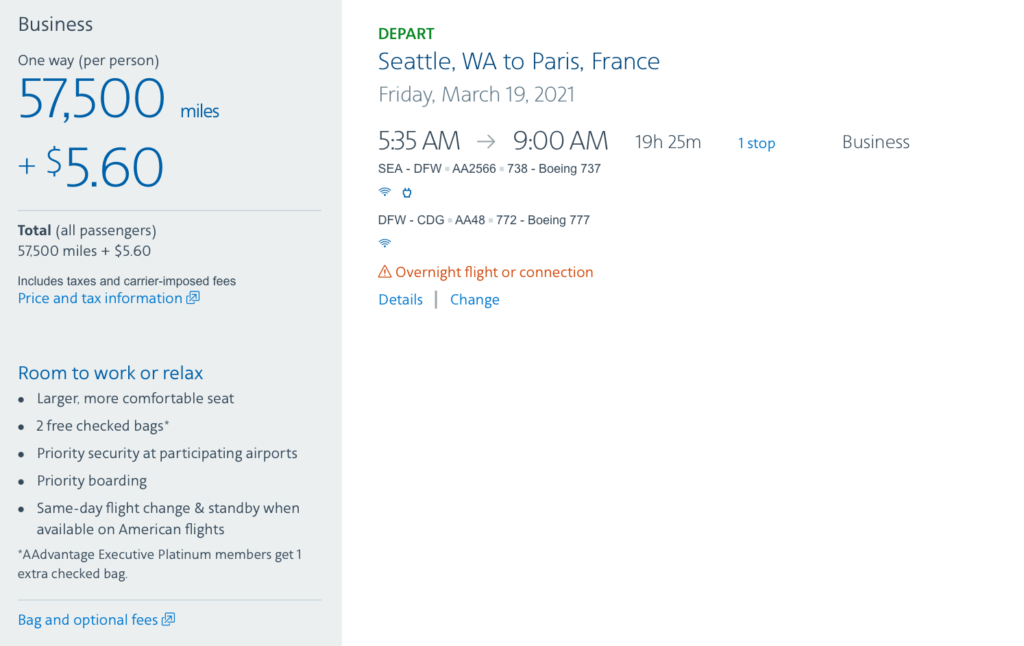

If you used those miles for a one-way ticket to Europe in Business Class, that would cost you around 57,500 miles. So, is it worth it for a one-way business class ticket to Europe for $360? Again, I’d say yes.

A round trip ticket to Miami from Seattle runs around 45,000 miles for first class. Is it worth it for a round trip first class ticket to Miami for $360? I’d suppose that’s also a yes.

There aren’t that many cases where earning 60,000 miles for a low amount like $360 isn’t worth the cost, so if you’ve got the money and you’re looking for a place to park it, the reward certainly seems to pay off.

February 13, 2021

If your 1099 states $360, that’s earned income, not tax. You will owe at most whatever your marginal tax rate is on that earned income. If you are in the 12% tax bracket, you will owe 12% of $360 in federal tax, or $43.20. The US does not tax you anywhere near 100% of income.

Depending on the state you live in, you may also owe state income tax.

February 13, 2021

The 1,000 miles bonus for your feedback is not included. Once you remove that, you will get precisely 0.0042 for the 1099.

Your are NOT limited to earning miles on the first $60,000.

February 14, 2021

hii

yes American Advantage miles that they give out in lieu of interest on their savings accounts. We were concerned because they never actually gave a monetary amount to those miles.

February 14, 2021

Agreed. It’s a great way to earn miles. And it’s safe as they’re FDIC insured. Recently sold our house not sure what we’re doing next and put the entire sale of the house in two separate accounts with Bask bank.

February 14, 2021

Yeah, my 1099 from Bask was $145 for 46,527 miles — about .003 per mile.