Citi offering a 25% Thank You Point Bonus (Targeted?)

Check your email box, I did and it paid.

I was about to delete another random email from Citibank but then I decided to open it up. Trying to be better about unsubscribing to emails instead of just deleting them I’m glad that I looked at this one. If you’re a fan of Citi Thank You points, this is a good day for you!

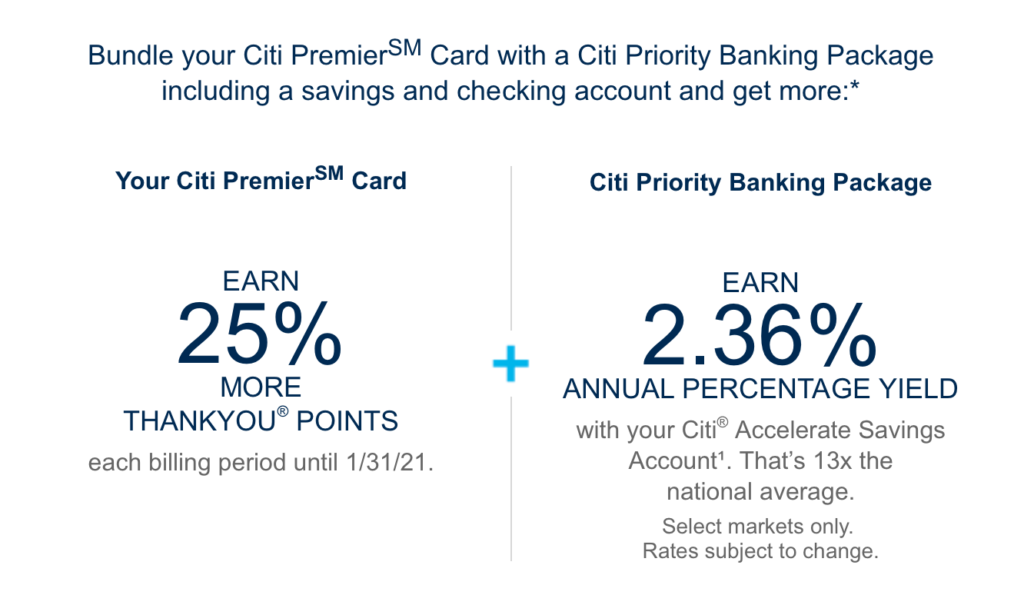

It would appear that Citi is offering a 25% bonus on all Thank You points earned when you pair your Citi credit card with a checking account. I’ve got the Citi Premier Card (offering currently 50,000 points at sign up) and the offer looks to be semi-targeted. The good news is that it is a bonus for well over a year and half. It expires in 2021, and that’s one of the longest promotions that I’ve seen in a very long time. Here’s what the email looks like and the terms and conditions.

Terms and Conditions

ThankYou Points Booster If you are an Eligible Customer and open the Eligible Deposit Accounts, subject to the requirements for continued eligibility discussed below, you will earn 25% more ThankYou Points (“ThankYou Points Boosterâ€) on purchases made with the Citi credit card designated in the Offer (“Card Accountâ€) until 1/31/2021. During the term of this Offer, we will multiply the total amount of ThankYou Points earned for a billing cycle by 25% and add that resulting number of ThankYou Points to your Thank You Rewards Account. For example, if you earn 1,000 ThankYou Points in a billing cycle per the terms of your Card Account, you will earn an additional 250 ThankYou Points for that billing cycle. The initial ThankYou Points Booster will be applied to the ThankYou Points earned for purchases made during the billing cycle no later than the billing cycle immediately following the billing cycle during which the Eligible Deposits Accounts are opened and eligible for transaction activity.

So, it would seem that the bonus points are in addition as well to all of the other bonus points you earn. As you can see, it says that they will multiply the total number of points earned by 25% and add that to the account. That means you’re now earning 1.25, 2.5, and 3.75 for all the bonus categories on the card. Not a bad haul indeed!

Fine Print (There is Always Fine Print)

First off it appears that the offer is only valid if you’re been targeted for the offer, so make sure to check your email inbox (or spam folder) for more information. Also, the type of checking account that it requires is one that has a minimum balance qualifier of $50,000 in combined balances. If you don’t have that amount in the account, you will be charged $30/month.

Assuming that you did NOT get the minimum balance, and assuming Citi’s rules are the same as Chase’s rules (you get 90 days to get the balance up) you could open the account today and not see a monthly fee until July 28th. August-January would be 6 months at $30/month.

- 18 months x $30/month

- Total = $540

- Points to offset at 2 cents each, 27,000

No Mas gives all flexible currencies a minimum of 2 cents value each, so you would need to earn at least 27,000 bonus points during the promotion to offset the $30 monthly fee.

- At 1x = $108,000 in spend from now until January 31st, 2021

- At 2x = $54,000 in spend from now until January 31st, 2021

- At 3x = $36,000 in spend from now until January 31st, 2021

Of course, all these calculations are moot if you can maintain the $50,000 in the account without any issue. As a cherry on top, the savings rate of 2.36% is a heck of a lot better than some of the other crappy interest bearing accounts out there right now in the market, so it might be worth a look.

If you don’t have the Citi card, like I mentioned above, they’re offering 50,000 points right now at sign up. You’ll earn double points at restaurants and entertainment and triple points on travel including gas stations.

April 29, 2019

FYI you have to get BOTH the checking AND savings account for the offer

April 29, 2019

bonus is probably based on base earnings, so 250 BONUS on 1000 no matter what the category…the 2x or 3x category will also earn BONUS points based on the base amount and will not stack a bonus on top of a bonus….I could be wrong, but I doubt it.