Why I’m not getting excited over this credit card…

We just got back from the Olympics in Rio (as you may have read…) and the experience was amazing. It’s one of those once-in-a-lifetime experiences for many people, and I’m really grateful to have had the chance to go

I also had the chance to go back in 2012 as well, so here’s to hoping that Tokyo 2020 will also become a reality!

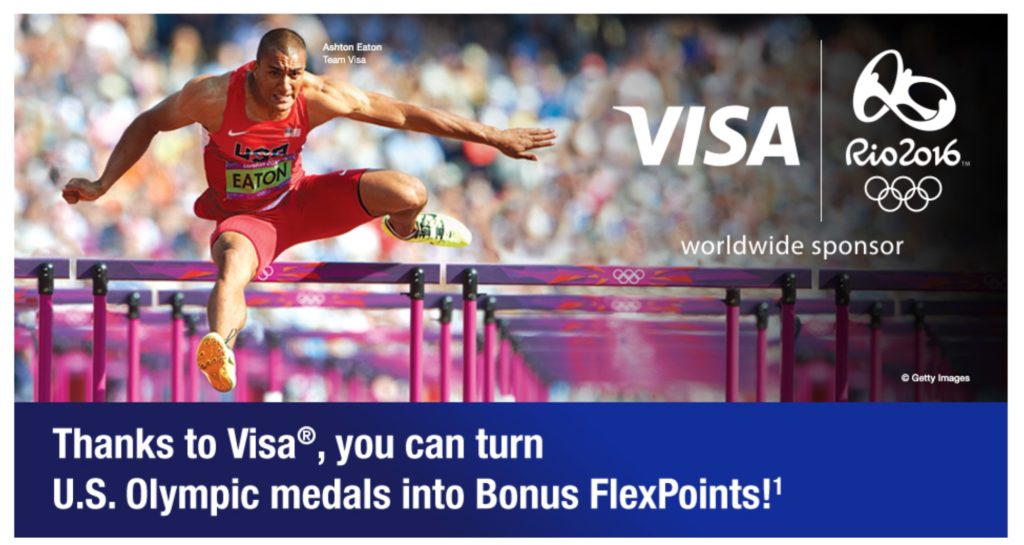

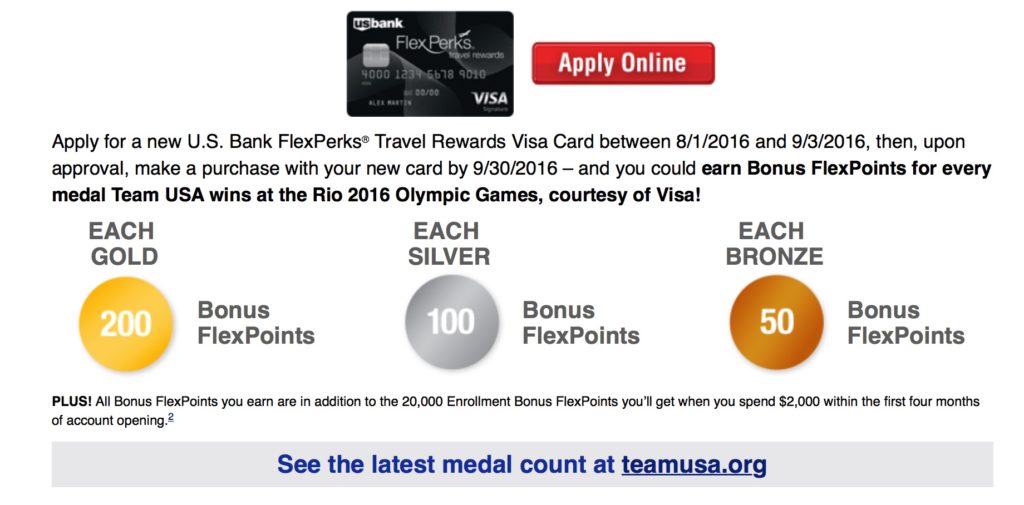

US Bank has partnered with the US Olympic team and Visa to launch a special promotion for these Olympic Games for those interested in the FlexPerks credit card

The promotion itself is pretty good! The normal credit card bonus for FlexPerks is 20,000 points, but in this promotion, you’re going to get extra bonus points for the US Olympic medal count.

Team USA killed it at the Olympics with an awesome medal count. According to the terms of the promotion, you’ll earn

Gold 46 x 200 = 9200

Silver 37 x 100 = 3700

Bronze 38 x 50 = 1900

The total for this promotion would be 14,800 above and beyond the 20,000 normal points. That’s a 74% boost over the normal promotion, a heck of a value! Each point is valued at around 2 cents, so that’s around a $696 value.

But, here’s the real crux of the situation for us (and our specific situation). I just can’t see us using this in any meaningful way past its promotional offer. Here’s the standard earning terms for the card:

- Earn 1 FlexPoint for every $1 of eligible net purchases charged to your card.

- Earn Double FlexPoints for every $1 spent at gas stations, grocery stores or airlines – whichever category you spend most on each monthly billing cycle – and at most cell phone service providers. (Business Edge Travel Rewards cardmembers earn Double FlexPoints for every $1 spent at gas stations, office supply stores, or airlines – whichever category you spend most on each monthly billing cycle.)

- Earn Triple FlexPoints for charitable donations. Choose from a wide range of eligible local, national and international charities.

We’ve already got so many cards between us that are clamoring for our attention, and they all offer excellent bonuses. We’ve got cards for airline bonuses, gas station bonuses, grocery store bonuses, and if we’re being honest, the charitable donations probably aren’t going to happen on a large enough scale to make this worth while.

Should you get this card?

Why not! It’s a fantastic value that has a huge signup bonus. It’s not often to see ~$700 signup bonuses on cards so if you were on the fence about something to sign up for, this is a great option. Not for us, however. We’re gonna hold out for a better option coming down the line in the future!