Strategically Apply for Credit Cards for a Higher Credit Score

With credit cards posting sign on bonuses of 30,000, 50,000, and even up to 100,000 miles or points with each signup, it can get tempting to go crazy and start applying in a mad rush to get as many as possible. The problem with this comes when your credit score plummets and causes problems down the road when you want to get that house, that car, or that student loan.

There does exist a strategy that has worked for us for a very long time and has allowed us both to keep over 800 credit scores for years. While this may not be a tried and true method for you and your credit situation, it’s one that has worked for us. Hopefully you’ll be able to use it to improve your score and chances long term.

Understanding the score

The first thing to understand about a credit score is what it represents. In its most simple form, a credit score is a number that relates to your creditworthiness. In otherwords, the higher the score, the more likely you are to be a low risk to a lender. A higher score means that you should, in theory, be able to pay back your debts and in turn, lenders (banks, creditors, etc) will be more likely to give you money.

You’ve got more than one credit score as there is more than one credit reporting agency. Equifax, Experian, and TransUnion all have different scores and can vary widely between them.

While the factors and their exact effect on your score is unknown, the basic components are the same:

- Your payment history

- How long you’ve had credit

- The types of credit you have (cards, loans, mortgages, etc)

- Your credit limits and your usage

- How much debt you have

- Hard inquiries on your report

Banks are here to make money

Credit cards are a huge money maker for banks. They generate millions if not tens or hundreds of millions of dollars every year for the banks, and earning a portion of your wallet share is their top priority. These huge signup bonuses are here to do that.

Put yourself in the position of a bank. Someone comes to you and asks 10 times in the course of a year for a line of credit. You’re the 11th bank. Why in the world would that bank want to give you another line of credit? This is what happens with most credit card churners. They don’t seem to understand why the bank is denying them another credit card application.

Everything in Moderation

The key to keep your score high is to do everything in moderation. As a former banker, I cringe when I hear someone say “I’ve signed up for 28 credit cards in the past year alone!” And then they wonder why they have a low score and no one is approving them for anything else.

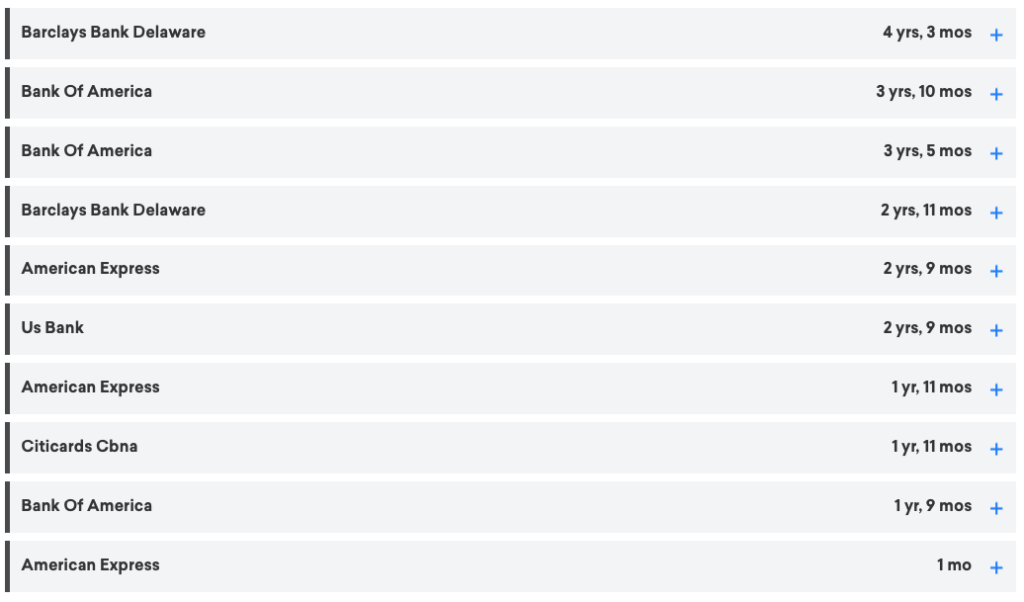

Here’s a snapshot of the past 5 years of my credit card profile:

It had been almost 2 years since my last application, and I just got one last month. As you can see, there’s plenty of space in between applications, so I haven’t gone crazy.

I haven’t been denied in over 5 years for a credit card, and I sure hope that it continues!

Mix of Credit

While credit cards are all the rage for miles and points, one way to make sure that your score stays high is to have a good mix of credit. Auto loans, mortgages, home equity lines; all will help to bring up your score and cushion you against the heavy credit card churning.

Spread the Love

Make sure that you’re applying for cards from a mix of financial institutions. Just applied for Barclay’s? Try US Bank or Bank of America. There are plenty of credit card options across all the banks that would be easier to get approved for.

When I recently applied for my American Express card I was given a really low credit limit. When I called to talk to someone about the limit, they said that I had too much credit open with them already.

Some banks will allow you to move around credit limits between cards (and some from business to personal) but American Express just stopped that practice. I might not be able to use that card which means that I’m going to have to close that card if they don’t bring the number higher.

Paying your cards

Many people wait until the bills arrive to pay the bills. I’ve found that one of the easiest strategies to keep them knocking down MY door is to pay off the cards as quickly as possible.

I’ve had the habit of sitting down every Sunday morning and paying my credit cards. That way when the bill comes, it’s zero or at least close to it. Showing that you have the funds and the desire to pay off the credit cards will look good in the eyes of any bank!

Closing Cards

Most of the cards don’t provide a ton of ancillary value past the first year if you’ve already got 10-15 cards. Even some heavy spenders can’t spend enough across that many cards to justify having them open.

Once you see the annual fee hit the card, it’s time to call the credit card company. Let them know that you’re considering closing your card and you’d like to see if there are any retention offers.

If you’ve even pretended to use the card, chances are they’ll give you a bonus, usually spend related, to keep the card. Last time I tried and close my Aviator card rom Barclay they offered me 20,000 American Airlines miles to just keep the card for another year. When I said I wanted the annual fee waived too, they said yes! You never know until you ask.

Review

So, want the bonuses and the high score?

- Apply infrequently

- Apply at different banks

- Don’t forget the other loan products

- And of course, PAY on TIME!

March 12, 2018

Obviously your system works in a way that you are pleased with, but my view is that going so slowly is foregoing a huge number of points. I’ve stayed at about 14/24, sometimes higher, for the last few years or so with two denials. I’m sure plenty of others would say I’m going too slowly! I keep intending to slow down, and will probably eventually have to because of changes with bank rules. Lots of other good advice and I should probably try harder to have a better organization system for paying in advance.